Just a nice inside day, ultra-low volume session that offered up two nice range extreme trade ideas.

Wednesday, November 27, 2013

Tuesday, November 26, 2013

Holiday Balance

Nice example of the bullish tendencies when an excess tail forms at the prior day's low or minor low 1st hour. Nothing but continuation grind higher.

But it was an inside range session and the grind higher hit yesterday's highs to the tick last hours, and a nice series of sell bars took price bad to VAL.

Great trades all day today, just volatility was so low that it was imperative to adjust targets accordingly.

But it was an inside range session and the grind higher hit yesterday's highs to the tick last hours, and a nice series of sell bars took price bad to VAL.

Great trades all day today, just volatility was so low that it was imperative to adjust targets accordingly.

Monday, November 25, 2013

Slow...

Not much to talk about today. Pre-holiday cash range was about a point and a half for most of the session.

And we expect more of this tomorrow unless something comes along to shake the the buyer's tree.

And we expect more of this tomorrow unless something comes along to shake the the buyer's tree.

Friday, November 22, 2013

As Expected

Yesterday we felt a test of the highs was on tap, and that's what printed today. They tested and cleared the 1800 zone.

Barring any new negative news, we expect the holiday grind to continue higher next week with low volatility but are on watch for swift inventory corrections.

Barring any new negative news, we expect the holiday grind to continue higher next week with low volatility but are on watch for swift inventory corrections.

Thursday, November 21, 2013

As Planned: Up Day

Sometimes the Crew here just does not need to out think ourselves, do we? Great insights yesterday!

As we pointed out yesterday, the Fed move down rejection at mechanical S2 quite possibly indicated some lolly-gagging around by the sellers. And we all to well know what such instances of lolly-gagging just might translate to going forward in this market.

On cue, buyers came in early on today and ripped higher it to R1, where it based at this level for two hours. Then a cutesy VWAP little pullback, perfect test, and reversal. (Always a great mechanical continuation signal)

The trade of today was to take heed of the VWAP reversal and triangulation at R1 range highs -- along with yesterday's range highs looming just above to suck in price in for a liquidity test.

Tomorrow we expect at the very least balance, but most likely a bull market push back to test the 1800 zone.

Holidays are here and Santa is apparently wearing his hat.

Downside? Ha! Maybe if it fails from a test higher.

As we pointed out yesterday, the Fed move down rejection at mechanical S2 quite possibly indicated some lolly-gagging around by the sellers. And we all to well know what such instances of lolly-gagging just might translate to going forward in this market.

On cue, buyers came in early on today and ripped higher it to R1, where it based at this level for two hours. Then a cutesy VWAP little pullback, perfect test, and reversal. (Always a great mechanical continuation signal)

The trade of today was to take heed of the VWAP reversal and triangulation at R1 range highs -- along with yesterday's range highs looming just above to suck in price in for a liquidity test.

Tomorrow we expect at the very least balance, but most likely a bull market push back to test the 1800 zone.

Holidays are here and Santa is apparently wearing his hat.

Downside? Ha! Maybe if it fails from a test higher.

Wednesday, November 20, 2013

Tuesday, November 19, 2013

Great Balanced Day!

Inside range, low confidence, slight downwards bias today, and it all smacks of laggard sellers that are going to get their heads ripped off yet again from another push higher. How far off can it really be?

We have been highlighting how well the pivots have been working in this grinder up. Low confidence tests of them get the programs all hot and bothered -- and poof! Yet another reversal materializes at S1.

And, oh, those 1st hour and a half minor low print reversals of the previous session sure print over and over again! In the context too of our upside bias of yesterday's structure.

Trades of the day were the early session minor low of yesterday's range lows (how many times have we seen this?) and the afternoon look down to S1 and a minor low of the previous session lows. (S1 yet again!).

We have been highlighting how well the pivots have been working in this grinder up. Low confidence tests of them get the programs all hot and bothered -- and poof! Yet another reversal materializes at S1.

And, oh, those 1st hour and a half minor low print reversals of the previous session sure print over and over again! In the context too of our upside bias of yesterday's structure.

Trades of the day were the early session minor low of yesterday's range lows (how many times have we seen this?) and the afternoon look down to S1 and a minor low of the previous session lows. (S1 yet again!).

Monday, November 18, 2013

1800 Liquidation Event

The programs sure are cute. High of the day today was 1799.75 and that was all she wrote.

The morning 7:00 look down, and gap fill minor low of the fill zone, was the long entry trade of the day, and classic bull market structure.

But the pushes higher could not get above R1 and a 11:30 liquidation event ensued. The test and rejection of the whopping round number 1800 was the program's trigger in my opinion. The really obvious references are what the program's love best.

Going forward into tomorrow, afternoon liquidation events are considered bullish for the following day. Just weak hands getting shaken out. But as I always say, a ball buster downside push is way freaking overdue.

Is 1800 reject going to get follow-through?

The morning 7:00 look down, and gap fill minor low of the fill zone, was the long entry trade of the day, and classic bull market structure.

But the pushes higher could not get above R1 and a 11:30 liquidation event ensued. The test and rejection of the whopping round number 1800 was the program's trigger in my opinion. The really obvious references are what the program's love best.

Going forward into tomorrow, afternoon liquidation events are considered bullish for the following day. Just weak hands getting shaken out. But as I always say, a ball buster downside push is way freaking overdue.

Is 1800 reject going to get follow-through?

Thursday, November 14, 2013

Laggard Grind Higher?

Textbook creeper grinder with no program TICK.

I did a little study on patterns of the advance/decliners on the daily. This sediment has been a pretty good indicator portending swings lower for the last year, and we wonder if it will pull yet another rabbit out of a hat.

That being said, with the holidays upon us, and lower volume, there may not be a seller to be had for who knows how long.

I did a little study on patterns of the advance/decliners on the daily. This sediment has been a pretty good indicator portending swings lower for the last year, and we wonder if it will pull yet another rabbit out of a hat.

That being said, with the holidays upon us, and lower volume, there may not be a seller to be had for who knows how long.

Wednesday, November 13, 2013

New Highs

That didn't take long!

New highs!

The structure we pointed yesterday out did in fact setup for an upside push today, despite a bit of overnight selling producing a small gap down at the cash open.

Right from the get go, structure indicated that buyers were in firm control. The morning push up triangulated for a bit, and then exploded out of that coil at 9:30 (Trade of the day).

Since we had strongly handicapped a breakout attempt upside push higher, it made a lot of sense to hold the morning long trade for a spell : ) (versus a mechanical +4)

New highs!

The structure we pointed yesterday out did in fact setup for an upside push today, despite a bit of overnight selling producing a small gap down at the cash open.

Right from the get go, structure indicated that buyers were in firm control. The morning push up triangulated for a bit, and then exploded out of that coil at 9:30 (Trade of the day).

Since we had strongly handicapped a breakout attempt upside push higher, it made a lot of sense to hold the morning long trade for a spell : ) (versus a mechanical +4)

Tuesday, November 12, 2013

Churn Day

We didn't blog about yesterday's holiday coma-fest, but we did feel that today would be an up day. And that didn't quite pan out.

What we got today was morning balance and a very low confidence chop lower right to S2 and the 1st initial balance extension line. Trade of the day! And then the buyers came in for the reversal.

These simple indicator reference zones are so amazingly obvious, yet they work so many times as the big programs key off of them. No PhD in mathematics required here folks.

We think up tomorrow as the last two days smell of continuation higher. Should a move back down to the bottom of the daily range print, then we starting thinking along the lines of possible topping action.

The buyers should pounce here. Although there are a few flags, like emerging markets diverging hard to the downside.

What we got today was morning balance and a very low confidence chop lower right to S2 and the 1st initial balance extension line. Trade of the day! And then the buyers came in for the reversal.

These simple indicator reference zones are so amazingly obvious, yet they work so many times as the big programs key off of them. No PhD in mathematics required here folks.

We think up tomorrow as the last two days smell of continuation higher. Should a move back down to the bottom of the daily range print, then we starting thinking along the lines of possible topping action.

The buyers should pounce here. Although there are a few flags, like emerging markets diverging hard to the downside.

Friday, November 8, 2013

Green Friday

It's been a long time since we put a low odds call out there and have it print right right back in our little 'ol faces. Hello trend day higher Friday. Geez.

It almost does not seem real. Either it was a fake out, or this market just showed how well bid it really is.

Today went up on neutral extreme sediment and lower volume versus yesterday's move lower. Not sure if that means anything but I'm pointing it out.

No call out for Monday's action. Just have to pounce on successful breaks from the range or any look above and fail.

It almost does not seem real. Either it was a fake out, or this market just showed how well bid it really is.

Today went up on neutral extreme sediment and lower volume versus yesterday's move lower. Not sure if that means anything but I'm pointing it out.

No call out for Monday's action. Just have to pounce on successful breaks from the range or any look above and fail.

Thursday, November 7, 2013

Red Bar

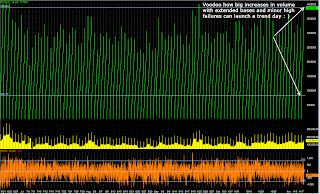

So what did we see from structure in the 1st hour that gave us strong odds for a trend day lower? That the sellers had arrived?

1) Overnight UE spike to over the range highs and reversal.

2) Early cash session minor high of yesterday's range highs and the prior all time highs. And folks, when this sort of stuff happens in a 9 day range, it is just utterly perfect reversal structure.

3) IB volume picked up strongly. In fact it was an eleven day breakout. End of day volume was a 34 day breakout.

Trade of the day was to get short that minor high early on. If not short, then the VWAP reversal short get's trade of the day number two. With overhead structure like it was, what a beauty.

Our suspicion noted in last night's analysis of sellers showing their hand turned out to be spot on.

We expect balance tomorrow, as a lot of folks are wildly short now. But we also appreciate that a significant triple top reversal like this at all times highs could have some legs to the downside.

I also think that a blatant green reversal bar tomorrow is low odds.

On to the slides...

1) Overnight UE spike to over the range highs and reversal.

2) Early cash session minor high of yesterday's range highs and the prior all time highs. And folks, when this sort of stuff happens in a 9 day range, it is just utterly perfect reversal structure.

3) IB volume picked up strongly. In fact it was an eleven day breakout. End of day volume was a 34 day breakout.

Trade of the day was to get short that minor high early on. If not short, then the VWAP reversal short get's trade of the day number two. With overhead structure like it was, what a beauty.

We expect balance tomorrow, as a lot of folks are wildly short now. But we also appreciate that a significant triple top reversal like this at all times highs could have some legs to the downside.

I also think that a blatant green reversal bar tomorrow is low odds.

On to the slides...

Wednesday, November 6, 2013

Shocker : )

Shocker that they gapped it up and then gunned it to the all time highs, just a tick or two shy, mind you. The crew here never expected that, did we? lol

But those visual highs were rejected with a swift move lower into the gap, and then the per-usual 8:00 LOD reversal and creeper grinder higher for the rest of the day.

Oh, those bull market programs!

Today's failure at highs does cast some suspicion as to whether or not the buyers are going to show themselves tomorrow. A plunge back into the 9 day range would not surprise. Nor would the buyers stepping back in to take it back above the highs.

UE report on Friday could just make for a range bound session tomorrow.

But those visual highs were rejected with a swift move lower into the gap, and then the per-usual 8:00 LOD reversal and creeper grinder higher for the rest of the day.

Oh, those bull market programs!

Today's failure at highs does cast some suspicion as to whether or not the buyers are going to show themselves tomorrow. A plunge back into the 9 day range would not surprise. Nor would the buyers stepping back in to take it back above the highs.

UE report on Friday could just make for a range bound session tomorrow.

Tuesday, November 5, 2013

We Got Your Number

Well, our test of highs thesis didn't play out (yet) today as the market gapped down.

But, oh, that 7:00 excess tail! And the following 5 minute bar printed an even bigger one -- with a TICK diverge.

Folks, significant reversal signals 1st hour and a half, in this bull market, are definitely valid trade signals.

The reversal was good higher just shy of the gap fill -- obvious destination. Then multiple pushes to range highs failed with divergences in TICK.

The 1st hour trade gets the vote as trade of the day long. But the last hour short at highs is a very close second.

We do have your number, market.

We think that today's action signals continuation higher as the high odds bet. Triangles in this market get bought. Plain and simple. A major failure here, has me really shocked -- and short most likely.

But, oh, that 7:00 excess tail! And the following 5 minute bar printed an even bigger one -- with a TICK diverge.

Folks, significant reversal signals 1st hour and a half, in this bull market, are definitely valid trade signals.

The reversal was good higher just shy of the gap fill -- obvious destination. Then multiple pushes to range highs failed with divergences in TICK.

The 1st hour trade gets the vote as trade of the day long. But the last hour short at highs is a very close second.

We do have your number, market.

We think that today's action signals continuation higher as the high odds bet. Triangles in this market get bought. Plain and simple. A major failure here, has me really shocked -- and short most likely.

Subscribe to:

Comments (Atom)