Boy 'o boy are these buyers responsive! A rinse move down to the 50 day and Ka-Pow! Short covering almost all the way back to highs in a V reversal day.

Volume way up, especially for a Monday!

Edge goes to buyers for tomorrow and we are long in the overnight.

Apple a great "salmon" stock today example. When the indexes puke, and a particular stock still stays strong, be prepared to go long that stock if the indexes recover. Apple just a perfect example of that dynamic today as it gunned new session highs while the indexes recovered.

Monday, April 28, 2014

Saturday, April 26, 2014

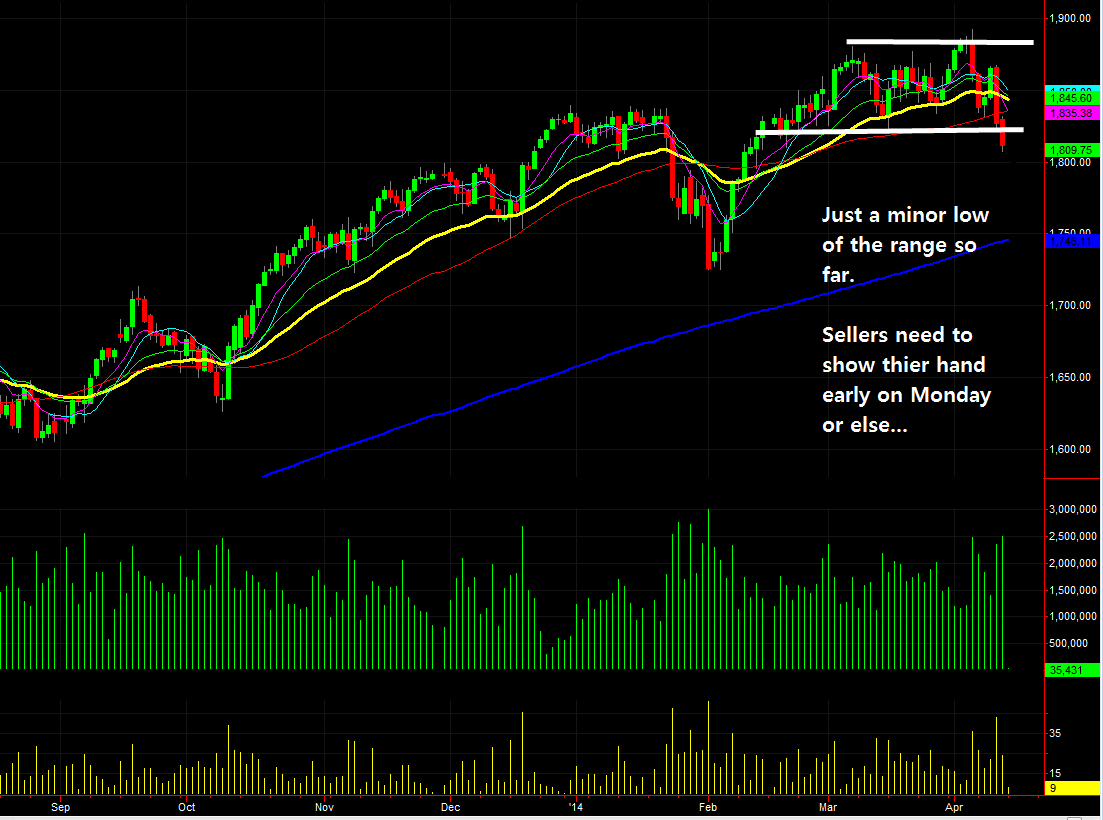

Red Friday

We thought it high odds up, but the market went down today. That's trading. I'm not surprised whatsoever that we tanked, given yesterday's underlying weakness underneath the hood and geopolitical negativity circulating.

On the intraday timeframe, trading today was spectacular. Price action totally symmetrical and VWAP offering up yet another great trade. But the trade of the day was the 11:30 minor low with excess tail. S1 and IB extension references there too boot.

I think that there is a very good chance that this market prints more selling come Monday. But I do not declare any actionable edge at this point.

We go through the analysis on the slides.

On the intraday timeframe, trading today was spectacular. Price action totally symmetrical and VWAP offering up yet another great trade. But the trade of the day was the 11:30 minor low with excess tail. S1 and IB extension references there too boot.

I think that there is a very good chance that this market prints more selling come Monday. But I do not declare any actionable edge at this point.

We go through the analysis on the slides.

Thursday, April 24, 2014

We were worried about a rinse lower, and that's what printed. The Apple euphoria spike was just a laggard-fest. We've noted so many times on this blog that spike bars are high-odds to get retraced.

Intraday, the morning move lower printed an initial balance minor low of the last two sessions, and rocketed higher to near range highs -- trade of the day.

Then inside range balance for the rest of the session.

Was today a yet another healthy consolidation day? Where weak handed longs get messed with? Or is a lower high on the daily going to print and selling is going to ensue? With only Apple really shining today, hiding broader market weakness?

We give the nod to the buyers tomorrow, as the upside all-time-highs destination trade is just so alluring. Long the 73's for the overnight.

Intraday, the morning move lower printed an initial balance minor low of the last two sessions, and rocketed higher to near range highs -- trade of the day.

Then inside range balance for the rest of the session.

Was today a yet another healthy consolidation day? Where weak handed longs get messed with? Or is a lower high on the daily going to print and selling is going to ensue? With only Apple really shining today, hiding broader market weakness?

We give the nod to the buyers tomorrow, as the upside all-time-highs destination trade is just so alluring. Long the 73's for the overnight.

Wednesday, April 23, 2014

After yesterday's successful breakout, today's inside range balance can only be construed as a pause before another push higher.

Big bad earnings out tonight, so we will wait before entering long in the overnight. Our bias is long for tomorrow. Should earnings be bad, we will alter our plan.

After hours: Apple is printing more money than the fed, and up we go. We chased entry at the 77's and are long. Much risk here in chase-mode. All time highs 1890 zone could be the destination tomorrow for this market. 1900 obviously a huge zone.

Last night's short paid and Monday night's short stopped out.

One lesson that we internalize once again this week is how grinder ups can do their thing with such extreme low confidence and low volume.

And still pump out more green days than seem reasonable.

VIX hovering at 13 after breaking below it briefly in yesterday's session.

Big bad earnings out tonight, so we will wait before entering long in the overnight. Our bias is long for tomorrow. Should earnings be bad, we will alter our plan.

After hours: Apple is printing more money than the fed, and up we go. We chased entry at the 77's and are long. Much risk here in chase-mode. All time highs 1890 zone could be the destination tomorrow for this market. 1900 obviously a huge zone.

Last night's short paid and Monday night's short stopped out.

One lesson that we internalize once again this week is how grinder ups can do their thing with such extreme low confidence and low volume.

And still pump out more green days than seem reasonable.

VIX hovering at 13 after breaking below it briefly in yesterday's session.

Monday, April 21, 2014

Zombie Grinder

No selling came in today but it was easy to shift gears and go with the grind higher intraday.

Volume PLUMMETED! Monday's have been prone to this, but geez. Lowest volume day of the year! Intraday range plummeted to 9 points.

A multi-day series of low confidence zombie grinder days always ends the same way -- with a Big Red.

No top calling for me, but at the swing high resistance zone right upon us, selling could very well materialize. On the flip side, isn't that liquidity zone at all time highs just too juicy for the programs to ignore?

We are short in the overnight as we expect some sort laggard long inventory adjustment move. If selling materializes intraday tomorrow, we will be leaning short with continuation entries.

Volume PLUMMETED! Monday's have been prone to this, but geez. Lowest volume day of the year! Intraday range plummeted to 9 points.

A multi-day series of low confidence zombie grinder days always ends the same way -- with a Big Red.

No top calling for me, but at the swing high resistance zone right upon us, selling could very well materialize. On the flip side, isn't that liquidity zone at all time highs just too juicy for the programs to ignore?

We are short in the overnight as we expect some sort laggard long inventory adjustment move. If selling materializes intraday tomorrow, we will be leaning short with continuation entries.

Thursday, April 17, 2014

Programs, Programs

These zombie buyers sure are predictable. One cue, the buyers took it up enough to fill our limit on the overnight position.

Today's range 16.50. Yesterday's range 16.50. Programs, programs.

Day trading today, the VWAP jumps out as trade of the day for the second day in a row. Programs, programs.

Our comment on the weekly bonds chart so happened to coincide with a puke trend day down today. Programs, programs.

Our bias is for some inventory to correct come Monday. But we are not going to back that opinion with a trade. At this point, I simply do not desire weekend risk. My brain requires detached rest from risk.

We are also going to look over the sectors and see how the overall market is playing out so far this year.

Today's range 16.50. Yesterday's range 16.50. Programs, programs.

Day trading today, the VWAP jumps out as trade of the day for the second day in a row. Programs, programs.

Our comment on the weekly bonds chart so happened to coincide with a puke trend day down today. Programs, programs.

Our bias is for some inventory to correct come Monday. But we are not going to back that opinion with a trade. At this point, I simply do not desire weekend risk. My brain requires detached rest from risk.

We are also going to look over the sectors and see how the overall market is playing out so far this year.

Wednesday, April 16, 2014

Great Trading Structure and 5150

Another transparent day in the indexes and our overnight long pays out. And we do note that the position should have been held for a swing versus a mechanical payout given the ultra-high confidence opinion we had.

Good day trading day too, with the morning drift lower offering a nice entry at gap fill zone on the TICK exhaustion move that could not budge price lower. Then buying the VWAP on the pullback yet another trade of the day -- although it took a lot of waiting for the payout.

So.. with zombie grinder higher days printing now, this market looks good to test the 1886 zone. And after that, highs once again.

If the sellers are going to crush the party, I think that it needs to happen tomorrow, or else the dog-pile higher will continue.

The nod clearly goes to buyers for tomorrow. But we watch out for inventory re-balances. Which makes an overnight entry susceptible to a rinse out.

We are long the overnight session once again. Low confidence, and in experimentation mode. It's a 1851.50 entry.

5150. That's us.

Tonight we feature bonds.

Good day trading day too, with the morning drift lower offering a nice entry at gap fill zone on the TICK exhaustion move that could not budge price lower. Then buying the VWAP on the pullback yet another trade of the day -- although it took a lot of waiting for the payout.

So.. with zombie grinder higher days printing now, this market looks good to test the 1886 zone. And after that, highs once again.

If the sellers are going to crush the party, I think that it needs to happen tomorrow, or else the dog-pile higher will continue.

The nod clearly goes to buyers for tomorrow. But we watch out for inventory re-balances. Which makes an overnight entry susceptible to a rinse out.

We are long the overnight session once again. Low confidence, and in experimentation mode. It's a 1851.50 entry.

5150. That's us.

Tonight we feature bonds.

Bonds are very interesting here.

Tuesday, April 15, 2014

Two Way Auction Process

The expected response came to pass -- up. But the "up" didn't last long, or display any spirited momentum -- and a move lower ensued.

As the move progressed, it became obvious that yesterday's range lows was the destination. And patience paid off, as the machines utterly pounced exactly at that level for a trade of the day higher.

Two way auction process at it's best. Volatility was way up today with a 35 point intra-day range.

After another spirited bout of responsive buying at non-breached range lows, this market looks good to go higher tomorrow. Obviously we note this fact after the overnight already being up somewhat, but we got long the close for an overnight entry. So our analysis is not pure hindsight.

Our overnight biases have been pretty darn excellent for a while, especially the last few weeks. So it's time to experiment with that edge. I don't do well typically in the overnight due to being west coast and not wishing to stay up until 1:00 and get up at 3:00 in order to mange positions (and stress out) throughout the night. But if my edge has improved to the point of being able to just let the trades run, without being stop-bait, then so be it. We will find out.

As the move progressed, it became obvious that yesterday's range lows was the destination. And patience paid off, as the machines utterly pounced exactly at that level for a trade of the day higher.

Two way auction process at it's best. Volatility was way up today with a 35 point intra-day range.

After another spirited bout of responsive buying at non-breached range lows, this market looks good to go higher tomorrow. Obviously we note this fact after the overnight already being up somewhat, but we got long the close for an overnight entry. So our analysis is not pure hindsight.

Our overnight biases have been pretty darn excellent for a while, especially the last few weeks. So it's time to experiment with that edge. I don't do well typically in the overnight due to being west coast and not wishing to stay up until 1:00 and get up at 3:00 in order to mange positions (and stress out) throughout the night. But if my edge has improved to the point of being able to just let the trades run, without being stop-bait, then so be it. We will find out.

Monday, April 14, 2014

Inside Day

Two ways to interpret balanced inside range day structure today in order to anticipate tomorrow's movement:

1) It shifts odds to buyers as weak handed shorts will once again panic cover with the green bar print on the daily. Can the buyers resist dog-piling upon a green bar?

2) It shifts odds to sellers as today's consolidation of two days of selling indicates a pause before a continuation move lower?

I think scenario number one gets the nod for tomorrow. Especially when contemplating intra-day structure. Price could not even explore to yesterday's range lows on the puke move from highs. And a V reversal from lows from hungry buyers too boot.

The minor low of the gap fill was the trade of the day long.

1) It shifts odds to buyers as weak handed shorts will once again panic cover with the green bar print on the daily. Can the buyers resist dog-piling upon a green bar?

I think scenario number one gets the nod for tomorrow. Especially when contemplating intra-day structure. Price could not even explore to yesterday's range lows on the puke move from highs. And a V reversal from lows from hungry buyers too boot.

The minor low of the gap fill was the trade of the day long.

Friday, April 11, 2014

Low confidence move lower

Low confidence move lower today. Odds shaping up for some sort of bounce attempt. That or the sellers keep pressing.

1800 zone a biggie.

Short post, busy with life.

Sectors update:

1800 zone a biggie.

Short post, busy with life.

Sectors update:

Slides:

Thursday, April 10, 2014

Crushed Buyers

Dang, out of the office on a fantastic liquidation day.

Our all too obvious long nod from yesterday was well overdue to be crushed (and oddly, I did note this fact)!

I would like to think that if at the desk, this would have been a stellar day.

Today could be a watershed downside event. But, still, price is only a minor low of the daily range.

The nod goes to sellers tomorrow, and it could be punishing. Or if the low of the range triggers buy programs, short inventory might find itself very uncomfortable once again.

Our all too obvious long nod from yesterday was well overdue to be crushed (and oddly, I did note this fact)!

I would like to think that if at the desk, this would have been a stellar day.

Today could be a watershed downside event. But, still, price is only a minor low of the daily range.

The nod goes to sellers tomorrow, and it could be punishing. Or if the low of the range triggers buy programs, short inventory might find itself very uncomfortable once again.

Subscribe to:

Comments (Atom)