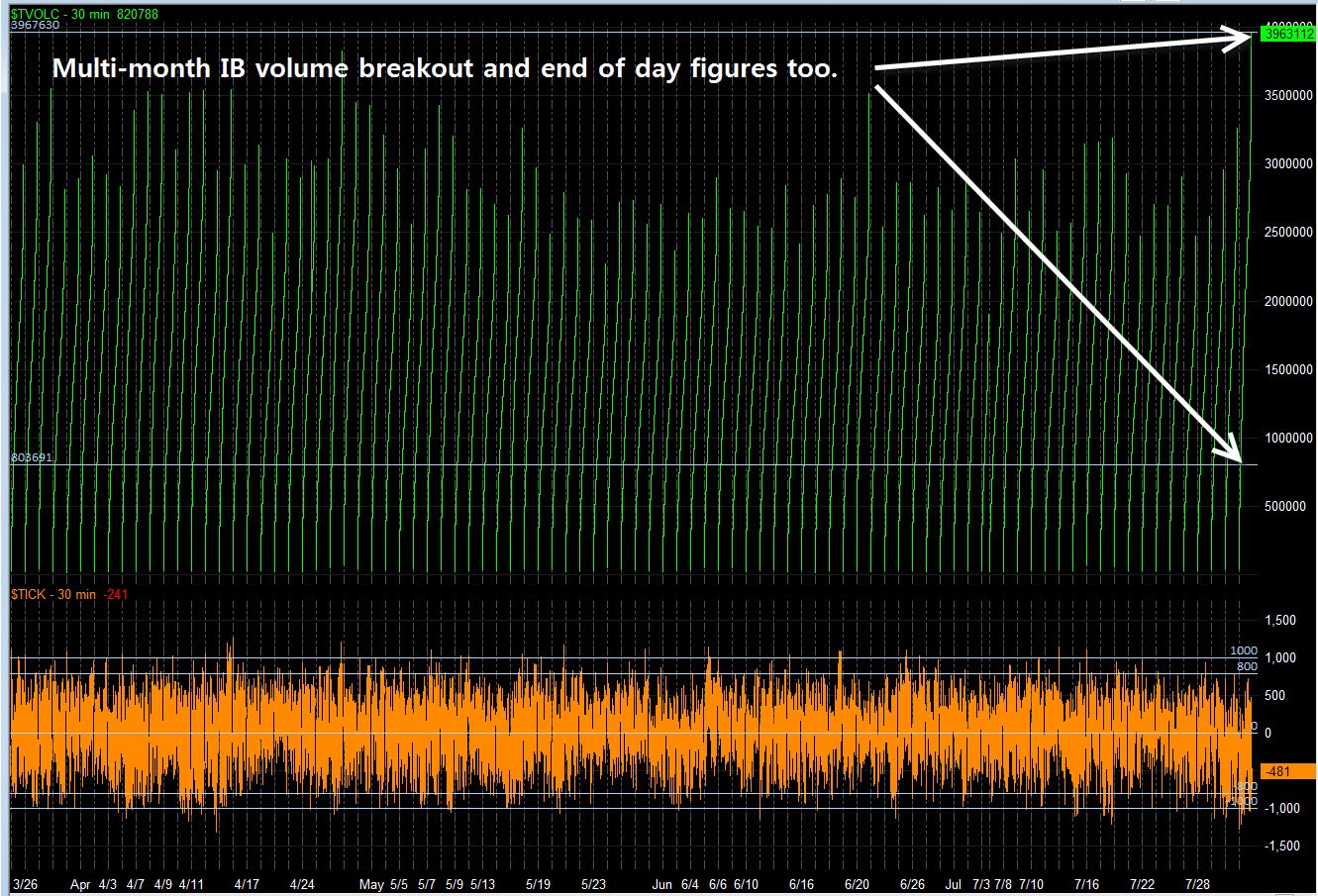

A classic institutional trend day.

Hello Big Red!

So many times, during this bull market, big volume down moves like this have been bought.

With all of the short inventory, we have to be on the lookout for a two way auction process short covering tomorrow.

But, there is always the possibility that a we may have a solid downtrend on our hands.

But that is a scenario that will have to prove itself.

Should any buying start to take hold tomorrow after a low confidence move lower, one must be very careful stepping in front of that train.

We feature the trade of the day quite a lot around here. But today's trade of the day gets special allocations for being structurally perfect. You won't find a better mid-session continuation short set up.

VIX up over 27%. You have to love it.