Wednesday, January 28, 2015

Tuesday, January 27, 2015

Balanced Day

This market sure has been printing some very benign morning moves lower that have resulted in rather ferocious up moves. It happened again today but the push higher petered out at a minor high of yesterday's range lows, which gets my nod as the asymmetrical trade of the day.

intraday slides

Monday, January 26, 2015

Thursday, January 22, 2015

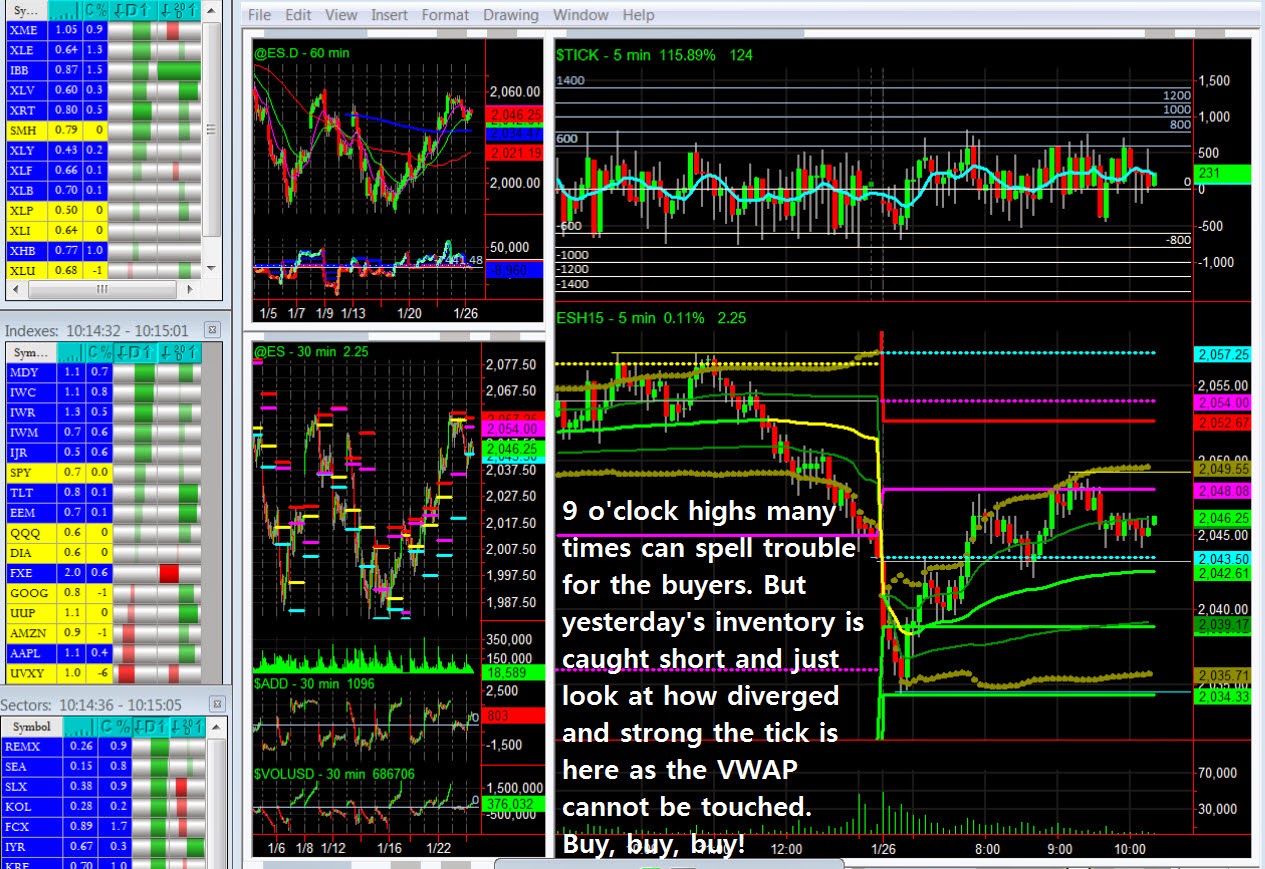

Going Up!

The morning look down could not even make it to 7 o'clock before an excess tail and reversal ensued.

It was clear inventory was still out of balance to the upside. And buy that break of the VWAP, and then buy for the breakout of morning range highs if not already long.

And the three-hour midsession base could not even test the VWAP and the tech MA was firmly above zero. All of the -600 tickets lower could not budge price below the supportive range. Lots of clues.

Today is one of the most spectacular examples of how a mid-session base breaks out, right at 11 o'clock, for a asymmetrical move higher break out of balance.

Great trading day!

Now that this market has not been rejected at the 2050 zone, we have to assume that the dog pile will continue. All-time highs is the major reference on the radar now.

A significant reversal here could have some teeth. But that is the low odds assessment at this point.

It was clear inventory was still out of balance to the upside. And buy that break of the VWAP, and then buy for the breakout of morning range highs if not already long.

And the three-hour midsession base could not even test the VWAP and the tech MA was firmly above zero. All of the -600 tickets lower could not budge price below the supportive range. Lots of clues.

Today is one of the most spectacular examples of how a mid-session base breaks out, right at 11 o'clock, for a asymmetrical move higher break out of balance.

Great trading day!

Now that this market has not been rejected at the 2050 zone, we have to assume that the dog pile will continue. All-time highs is the major reference on the radar now.

A significant reversal here could have some teeth. But that is the low odds assessment at this point.

Now let's look at the intraday and document the amazing structure as it unfolded:

Wednesday, January 21, 2015

Buyers

A rip snorting move higher first hour and a half gave away to 9 o'clock zone transitional structure. We point out time and time again that rip snorting extended five-minute bars are right for reversals and corrections.

And from there the pullback grind its way back until it reversed at 11 o'clock zone, at the prior session range lows.

This market is grinding higher than everyone I'm reading is looking for a pullback and new swing lows on the daily.

For me, I expect grinding higher to continue until it doesn't. The 2050 to the 2060 zone is the next major reference higher.

And from there the pullback grind its way back until it reversed at 11 o'clock zone, at the prior session range lows.

This market is grinding higher than everyone I'm reading is looking for a pullback and new swing lows on the daily.

For me, I expect grinding higher to continue until it doesn't. The 2050 to the 2060 zone is the next major reference higher.

Tuesday, January 20, 2015

Good Structural Cues

We were not surprised to see the faux selling reverse hard at 9 o'clock and S2. This was the trade of the day, however it's rather difficult to press your edge in anticipation of a full-fledged the reversal.

With yet another low confidence look down and reversal, it appears as though the buyers are taking charge once again and it will be higher prices ahead.

With yet another low confidence look down and reversal, it appears as though the buyers are taking charge once again and it will be higher prices ahead.

Friday, January 16, 2015

Hello Perfect Swing Day Structure

Last night you said: "I am of the opinion that the push higher is in the cards still, yet am cognizant of the fact that two days of basing action could be of the continuation lower variety."

Wednesday you said: "Quite amazing daily minor low today -- trade of the day. This sets the stage for buyers to take control.

Nothing that I have seen so far over this year indicates a total market breakdown.

We were wrong in our assessment yesterday that buyers would take control. BUT, selling today was so utterly low confidence right into the daily zone, and a vicious buying ensued at 11:00.

We think higher from here. If not the market could actually be toast."

Wednesday you said: "Quite amazing daily minor low today -- trade of the day. This sets the stage for buyers to take control.

Nothing that I have seen so far over this year indicates a total market breakdown.

We were wrong in our assessment yesterday that buyers would take control. BUT, selling today was so utterly low confidence right into the daily zone, and a vicious buying ensued at 11:00.

We think higher from here. If not the market could actually be toast."

So when you noted the overnight session print a minor low and reverse:

That was something to note as the regular session opened.

Let's now note the daily as we dive into intra-day slides.

Thursday, January 15, 2015

Basing Action

Today's range 30 points. And 90% of the session was balance below the VWAP. They couldn't break it down below yesterday's lows and they couldn't break at higher above yesterday's highs.

In the overnight so far, the daily range lows have been breached and reversed. This is bullish--so far.

We just have to see if responsive buyers continue to step in, or whether or not the daily range lows breach will garner more business.

I am of the opinion that the push higher is in the cards still, yet am cognizant of the fact that it two days basing action could be of the continuation lower variety.

In the overnight so far, the daily range lows have been breached and reversed. This is bullish--so far.

We just have to see if responsive buyers continue to step in, or whether or not the daily range lows breach will garner more business.

I am of the opinion that the push higher is in the cards still, yet am cognizant of the fact that it two days basing action could be of the continuation lower variety.

Subscribe to:

Comments (Atom)