And because of the bigger picture inventory issues, similar pattern can yeild very different results. And it really does comes down to if inventory is too long/short or not.

Let's take a recent example of this phenomena by evaluating the November 1st and December 6th overnight and day sessions only. Then we will consider previous day's structure into the equation.

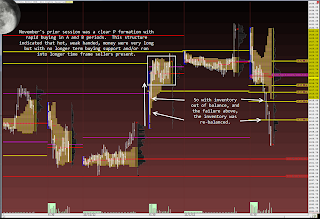

Now, let's take into consideration the previous sessions. 1st November

Then Friday's session.

This is one of the best examples of needing to always zoom out when day trading. Failure to be conscious of bigger picture structure can, many times, negate the value of inter-day pattern recognition.

But there were some clues to be had on the 5 minute as well.