Today's action was an almost perfect mirror of yesterday's print. A period tail and grind higher only to fall back into the range mid session.

We will point out some nice trading opportunities today and also marvel at a couple of 5 minute chart nuances that repeat over and over.

3 day inside range balance now, and I'm just not sure if the gap fill above is just too juicy to ignore, or if two day's of afternoon weakness are a sign that buyers are weak. Best guess is that they try for the gap again tomorrow in some fashion as it's month's end. A failure to do so, I think, shifts odds greatly to the sellers.

Thursday, August 29, 2013

Wednesday, August 28, 2013

Buy Response

Our analysis yesterday was right in sniffing out a quite a few nuances that could lead to a buy response. They didn't mess around today, a minor low A period look down and then the grind up was on.

But the buyers didn't put much fear into the hearts of sellers either. Volume was down and sediment was neutral extreme. And a P formation on the profile is not all that exciting for continuation higher, especially in the context of an inside range day.

My highest odds guess for tomorrow is some sort of continued push higher. The gap is above and a price-sucking void. But I'm not high confidence and am on watch for sellers.

But the buyers didn't put much fear into the hearts of sellers either. Volume was down and sediment was neutral extreme. And a P formation on the profile is not all that exciting for continuation higher, especially in the context of an inside range day.

My highest odds guess for tomorrow is some sort of continued push higher. The gap is above and a price-sucking void. But I'm not high confidence and am on watch for sellers.

Tuesday, August 27, 2013

Smash Bar

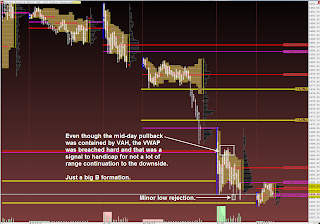

Sellers took control in the overnight session and the cash printed a 15 point downside gap that partially filled. Balance ensued and it was a rather rare double distribution grind lower out of this early balance. (selling normally gets it done quick)

Today's action confirmed that the sellers are in control now but action like today has my radar out for some weak, bad-priced sellers to cause some sort of squeeze higher. Usually from the following day's structure of a lethargic morning move lower with decreased momentum and then the up push comes.

But our overarching concern is that this market has topped out and sellers could very well firmly have the reins of this thing.

Today's action confirmed that the sellers are in control now but action like today has my radar out for some weak, bad-priced sellers to cause some sort of squeeze higher. Usually from the following day's structure of a lethargic morning move lower with decreased momentum and then the up push comes.

But our overarching concern is that this market has topped out and sellers could very well firmly have the reins of this thing.

Monday, August 26, 2013

Zombie Smash

Ultra low volume creeper higher session cracked later day to the downside. As we point out in our slides, IB volume lowest readings of the entire year! Epic example of pathetic grind higher structure that fails.

But as we have noted many times, liquidation patterns like this in grinder highers actually have a tendency to be bullish. But something makes me wonder...

This market is in a yearly zone that could spell major trouble.

But as we have noted many times, liquidation patterns like this in grinder highers actually have a tendency to be bullish. But something makes me wonder...

This market is in a yearly zone that could spell major trouble.

Friday, August 23, 2013

Zombie Grinder Friday

The title of this post is no joke!

IB move down to re-balance overnight inventory and then a reversal occurred above the overnight lows (and prior day's lows).

Same bull market pattern, and same outcome.

Then mid session balance above VWAP to feature a last hour push higher.

Surprised? Why?

TICK confirmed the late day push with it's MA hanging out above zero all day. And what about the fact that only (1) TICK -600 hit all day?

The Buyer Zombies leave their tracks. So why not enjoy eating the brains of the laggards too, like they are so expert at?

Thursday, August 22, 2013

Shutdown Day

Fairly decent sized gap up today. The session was a balanced - grinder higher all day long, despite someone tripping a circuit breaker at the Nasdaq and shutting it down for 3 and a half hours! And that spilled over to the NYSE volume being down today. Yet another inside range of the prior day, minus a late day look above minor high and fail.

Not sure if I'd rather be responsible for beaching the Costa Concordia or shutting down the stock market for 3 and a half hours. Really gives you confidence in the financial markets. One day it's going to shut down during a very high ATR scenario and the machines are going to firmly rape the public.

Oh, and due to spiking yields, the government is morphing the 5 year bond into a 7 year bond. Don't worry, you can trust the government. It's all perfectly logical to bend the system like this.

Interesting piece on internet security. Nowhere to hide.

Now that the programs have shown their buying hand, odds are they will just hit it again to the upside. So many are licking their chops for this market to tank, that it just may screw them all one more time. Or if it plunges back into the range, that too would not surprise.

Not sure if I'd rather be responsible for beaching the Costa Concordia or shutting down the stock market for 3 and a half hours. Really gives you confidence in the financial markets. One day it's going to shut down during a very high ATR scenario and the machines are going to firmly rape the public.

Oh, and due to spiking yields, the government is morphing the 5 year bond into a 7 year bond. Don't worry, you can trust the government. It's all perfectly logical to bend the system like this.

Interesting piece on internet security. Nowhere to hide.

Wednesday, August 21, 2013

Fed Minutes

This was an interesting chart of the day today:

Since the 2008 crash, US stocks are about 10% above the pre-crash levels. China is still in the dumper, indicative of the lunacy going on over in that neck of the woods. Apparently, India is the latest stone to drop.

If there ever was a zone for this market to roll over, this is freaking it.

Fed minutes rocked the market for the 1st time in quite awhile. The shake and bake is probably bearish but who the hell knows. The daily is in a firm grind lower for now, as the world continues to go to pot.

Range was 18 points today. Up a little but, but volume not up.

Since the 2008 crash, US stocks are about 10% above the pre-crash levels. China is still in the dumper, indicative of the lunacy going on over in that neck of the woods. Apparently, India is the latest stone to drop.

If there ever was a zone for this market to roll over, this is freaking it.

Fed minutes rocked the market for the 1st time in quite awhile. The shake and bake is probably bearish but who the hell knows. The daily is in a firm grind lower for now, as the world continues to go to pot.

Range was 18 points today. Up a little but, but volume not up.

Tuesday, August 20, 2013

Baby Bounce

What do you know? A bounce! That's what the odds told us.

But the up move stalled out a couple of ticks below yesterday's range highs. This metric shifts odds away from the buyers for tomorrow. Having said that, the trend is up, so the buyers have some odds themselves.

We highlight tonight how the the overnight printed a minor low of the prior session range lows and reversed. This is classic action and a wonderful structural cue that shifted odds to the long side early going for today's cash session.

Odds are probably for some sort of lower test tomorrow is my best take. Despite the cornucopia of positive inklings, I smell potential major topping action. But this call is monthly based, versus daily.

Sum Ting may just be Wong...

But the up move stalled out a couple of ticks below yesterday's range highs. This metric shifts odds away from the buyers for tomorrow. Having said that, the trend is up, so the buyers have some odds themselves.

We highlight tonight how the the overnight printed a minor low of the prior session range lows and reversed. This is classic action and a wonderful structural cue that shifted odds to the long side early going for today's cash session.

Odds are probably for some sort of lower test tomorrow is my best take. Despite the cornucopia of positive inklings, I smell potential major topping action. But this call is monthly based, versus daily.

Sum Ting may just be Wong...

Monday, August 19, 2013

Grinder Down

A long time ago, in a galaxy far, far away, downside action differed from upside action.

We got the grinder down today. Volume was low and pace/tempo lethargic. It's rather rare to get a downside low volume double distribution structure like this. It's really just an inverse upside check-mark pattern.

After three days of low confidence downside action, the windup for a reversal builds -- especially just under the 50 day reference. But, the 60 minute is in a definitive downside channel. Mess with that, and you just might find yourself wishing that you were in a different galaxy.

May the force be with you.

Odds are for a look higher tomorrow, at least that's my take.

We got the grinder down today. Volume was low and pace/tempo lethargic. It's rather rare to get a downside low volume double distribution structure like this. It's really just an inverse upside check-mark pattern.

After three days of low confidence downside action, the windup for a reversal builds -- especially just under the 50 day reference. But, the 60 minute is in a definitive downside channel. Mess with that, and you just might find yourself wishing that you were in a different galaxy.

May the force be with you.

Odds are for a look higher tomorrow, at least that's my take.

Friday, August 16, 2013

50 Day Churn

The high odds scenario played her hand today as today was a balanced day.

Morning balance gave way to a low momentum/volume double distribution look down below yesterday's range lows -- and subsequent failure back up into the range. The two references below, the 50 day and gap fill, were just to juicy for the programs to resist for a liquidity-run-test.

Mondays have been historically, as of late, snoozer-fests with little volume or range. If this metric changes early going it just might be a nice clue that "change is here".

A steady drip lower, or a powerful impulse by the programs to launch a reversal at the 50 day would not surprise me.

It's above my pay grade to make a call for Monday.

Morning balance gave way to a low momentum/volume double distribution look down below yesterday's range lows -- and subsequent failure back up into the range. The two references below, the 50 day and gap fill, were just to juicy for the programs to resist for a liquidity-run-test.

Mondays have been historically, as of late, snoozer-fests with little volume or range. If this metric changes early going it just might be a nice clue that "change is here".

A steady drip lower, or a powerful impulse by the programs to launch a reversal at the 50 day would not surprise me.

It's above my pay grade to make a call for Monday.

Thursday, August 15, 2013

Bang Ding Ow!

Breakdown lower today and it was nice to see confirmation of our bearish bias. Numerous downside clues showed themselves during in the last few days that we previously highlighted. To quote ourselves from a couple of day's ago Either it's a new world order or crappy under the hood action like this is going come home to roost at some point.

We pointed out bearish daily price formations:

a) Too extended of a tight base,

b) A minor new high look above the balance to all times highs and and failure,

c) A rounding top price formation.

We noted Intra-day structure featuring:

a) The TICK and how there were NO program high readings and frequent negative program readings.

b) For the 1st time we smelled that 2nd standard deviation Laggards were the ones buying -- and we were correct with this assessment.

With that, going forward into tomorrow, we most likely expect a balanced day.

Yet is is options ex day Friday on tap and a lot of studies are bullish for this day. That big gap up above might get a fill attempt.

A lackluster push below today's range lows might be an interesting long idea depending on sediment and tempo.

And of course if it viciously trends, we go with. But I think that this is the most unlikely scenario.

We pointed out bearish daily price formations:

a) Too extended of a tight base,

b) A minor new high look above the balance to all times highs and and failure,

c) A rounding top price formation.

We noted Intra-day structure featuring:

a) The TICK and how there were NO program high readings and frequent negative program readings.

b) For the 1st time we smelled that 2nd standard deviation Laggards were the ones buying -- and we were correct with this assessment.

With that, going forward into tomorrow, we most likely expect a balanced day.

Yet is is options ex day Friday on tap and a lot of studies are bullish for this day. That big gap up above might get a fill attempt.

A lackluster push below today's range lows might be an interesting long idea depending on sediment and tempo.

And of course if it viciously trends, we go with. But I think that this is the most unlikely scenario.

Wednesday, August 14, 2013

Sum Ting Wong

Sometimes it's just vitally important to highlight some of the financial media's best work. Here we feature today's headlines:

So what are the key metrics to gleam from this piece?

1) Stocks are "sliding" and "extending" to the downside for multiple days.

2) They are doing so over "Fed fears"

Heavy duty stuff. Ouch! Rampant fears causing all sorts of downside action. Right?

Or is it? The graphic says something is wong with their headlines.

I'm not saying that the market is not due to tank. I think this extended balancing action could well be a significant top.

Facts:

1) No extending to the downside as today is above yesterday's lows.

2) No sliding lower and yesterday was an up day.

3) No fears

4) No Shit

How the public puts up with this horrific, nonsensical, reporting is beyond me.

Today was a balanced grind lower to re-balance some of yesterday's weak handed long inventory we noted to most likely be laggards.

Key: Second day in a row of no upside +600 ticks and multiple -800 programs hits. The sellers are out, but not getting much for their efforts. Either it's a sign of them gaining control, or they will cover like babies if any buyers hit the tape.

We will see.

So what are the key metrics to gleam from this piece?

1) Stocks are "sliding" and "extending" to the downside for multiple days.

2) They are doing so over "Fed fears"

Heavy duty stuff. Ouch! Rampant fears causing all sorts of downside action. Right?

Or is it? The graphic says something is wong with their headlines.

I'm not saying that the market is not due to tank. I think this extended balancing action could well be a significant top.

Facts:

1) No extending to the downside as today is above yesterday's lows.

2) No sliding lower and yesterday was an up day.

3) No fears

4) No Shit

How the public puts up with this horrific, nonsensical, reporting is beyond me.

Today was a balanced grind lower to re-balance some of yesterday's weak handed long inventory we noted to most likely be laggards.

Key: Second day in a row of no upside +600 ticks and multiple -800 programs hits. The sellers are out, but not getting much for their efforts. Either it's a sign of them gaining control, or they will cover like babies if any buyers hit the tape.

We will see.

Tuesday, August 13, 2013

Are 2nd Standard Deviation Laggards On The Lose?

For me it's a new world order in the futures markets. What happened today, I've never scene before, or at least recall seeing.

A morning push down to the previous day's lows and a reversal at 7:30. Same as it ever was, as this pattern has occurred now 5 out of the last 6 days. Happens all of the time.

But today's subsequent straight shot, 2nd standard deviation punch to new highs, and double distribution move, happened on strongly balanced metrics.

Volume barely higher above yesterday's pathetic readings. Not even one +600 TICK reading for the entire push higher and one lone +600 reading last hour. Small caps majorly diverged as a host of other sectors. Advance decliners firmly negative all day. The day's ATR was even up a solid 50% without the increased volume to support such an increase.

But financials, semi's and tech were leading sectors today. And Apple printed a short squeeze breakout over it's 200 day.

Either it's a new world order or, crappy under the hood action like this, is going come home to roost at some point.

A morning push down to the previous day's lows and a reversal at 7:30. Same as it ever was, as this pattern has occurred now 5 out of the last 6 days. Happens all of the time.

But today's subsequent straight shot, 2nd standard deviation punch to new highs, and double distribution move, happened on strongly balanced metrics.

Volume barely higher above yesterday's pathetic readings. Not even one +600 TICK reading for the entire push higher and one lone +600 reading last hour. Small caps majorly diverged as a host of other sectors. Advance decliners firmly negative all day. The day's ATR was even up a solid 50% without the increased volume to support such an increase.

But financials, semi's and tech were leading sectors today. And Apple printed a short squeeze breakout over it's 200 day.

Either it's a new world order or, crappy under the hood action like this, is going come home to roost at some point.

Monday, August 12, 2013

Summer Balance

A 5 day low in volume today, 13 point 24 hour ATR, sediment neutral extreme, mostly an inside range day...

Hey, it's Monday in August.

Hey, it's Monday in August.

Subscribe to:

Comments (Atom)