We pointed out bearish daily price formations:

a) Too extended of a tight base,

b) A minor new high look above the balance to all times highs and and failure,

c) A rounding top price formation.

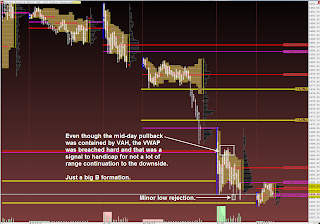

We noted Intra-day structure featuring:

a) The TICK and how there were NO program high readings and frequent negative program readings.

b) For the 1st time we smelled that 2nd standard deviation Laggards were the ones buying -- and we were correct with this assessment.

With that, going forward into tomorrow, we most likely expect a balanced day.

Yet is is options ex day Friday on tap and a lot of studies are bullish for this day. That big gap up above might get a fill attempt.

A lackluster push below today's range lows might be an interesting long idea depending on sediment and tempo.

And of course if it viciously trends, we go with. But I think that this is the most unlikely scenario.

No comments:

Post a Comment