Interesting to note all of the nuances missed after reviewing my posts of the last couple of weeks. But all of the metrics we follow do contain solid edge. The tricky part is actually pulling it off real time. Trading is not easy! I hope to keep stretching analytic analysis and documentation each day to make the time put in worthwhile. I know that I've improved greatly this year but do need to keep the thinking cap on for fresh approaches.

The Daily Auction:

So, what was our Friday splat all about?

1) A expansive break from balance with high volume and momentum closing on dead lows, suggestive that a youthful downside auction has begun?

2) Or, like for most of the last 5 years, will the buyers step back in soon after the Fed announces fresh quantitative easing for the millionth time?

Friday's Action Overall:

A solid high volume breakdown, sporting Goldilocks's downside price action. Mind you, not to hot (quick) or cold (slow). Just right. We are going to be using this term going forwards as I really like it!

Mid-session balance zone smelled of continuation and the 11:00 programs jumped on board to print another symmetrical leg to the downside.

Sediment NYSE:138 stocks up and 1923 down. Have not seen that in awhile, nor have we seen NYSE volume this high since June of 2013

Morning Session Clues:

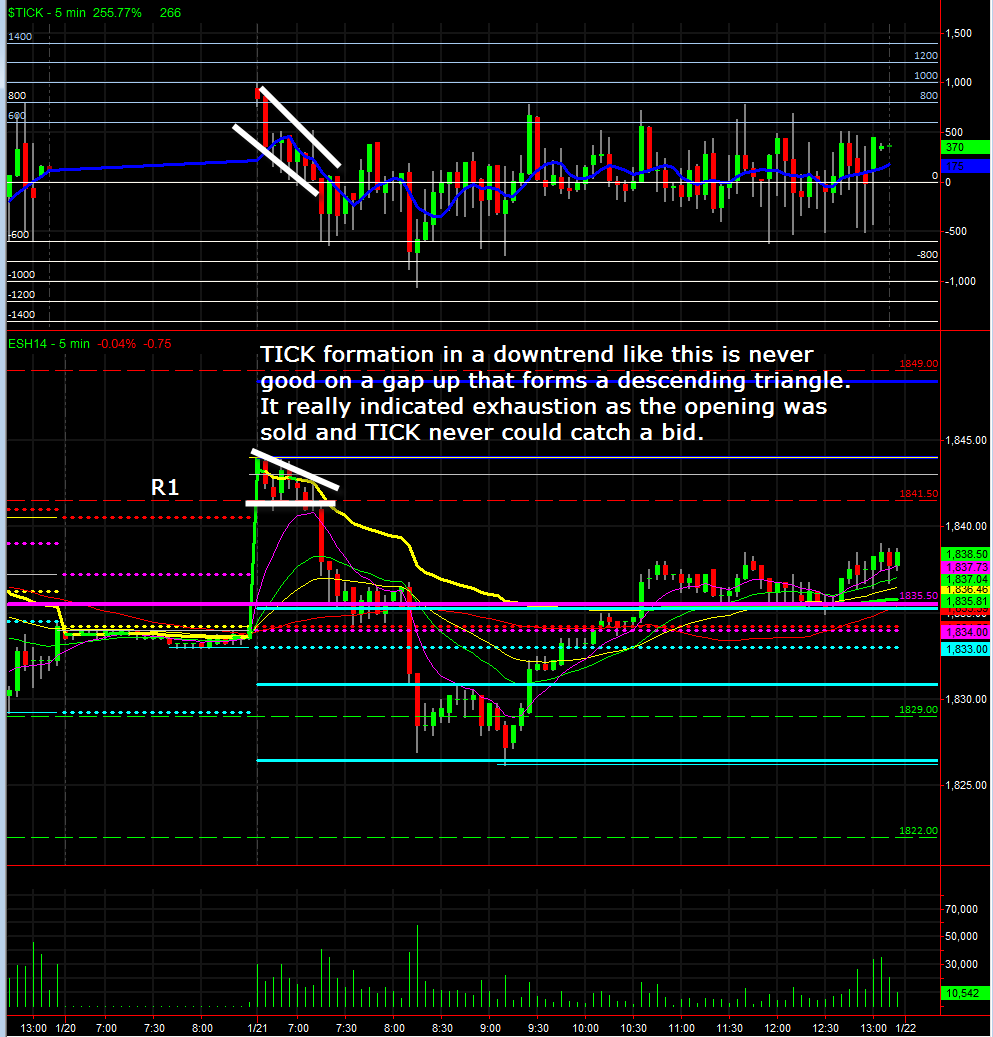

A true gap below yesterday's range, emerging markets firmly in the tank, increased volume over yesterday's readings, no TICK readings above zero to speak of, and sediment sub -2000 for the 1st time in quite awhile were tells early going that real sellers were in the house.

Mid-Session Clues:

Although the base was a bit longer than most true trend days, price could not test the vwap, and it kept printing lower highs during balance. And the TICK MA remained solidly under zero. Very suggestive of continuation lower.

Late Session Clues:

Once the 11:00 programs kicked in so perfectly, that was the tell to expect another leg lower. Goldilocks price action lower kicked in and it sure felt like shorts were not about to panic.

Monday's Session:

After a big trend day, odds are for balance. Pushes below Friday's low might offer up a decent trade long. Go with strong price action suggestive of selling continuation. If buyers step in, then short covering could washing-machine it up quick.

Onto the slides...

Intra-day slides