Monday, April 30, 2012

30 Minute Exercise

Before the open:

Last session we identified a few goals to focus on today:

1) Testing larger stops. Nothing under 5 points.

I've decided to be more volatility-based when choosing stop size. Daily ATR now averages about 17 for last couple of weeks. Dividing daily ATR by 3 gives us a stop of about 5 points. With today's 7 point range, I felt very comfortable using a two point stop on the small time frame.

2) Diligent odds-based thinking at reference zones and before I enter or exit.

I like how well you saw the afternoon false breakdown. Volume was just not strong enough to pull away from such an established value area.

3) Trying harder to find trades every 30 minutes (when not in a trade).

ATR was just too tight today.

4) Trying new tactics and ideas and discussing them.

I will for sure practice some tick fade trades when the day is right. They worked today, but a 1.5 point range is just too small.

After the session, your performance on each will be graded.

Review:

Last session (Friday) was a great example of afternoon look above the range highs and fail. It was also a great example of how powerful recency bias can be, as I clearly remember being influenced by Thursday's session where the breakout to new highs was very successful. But, as I noted, Friday's structure was much different than Thrusday's. Thursday featured an upside excess tail in A period, and Friday featured a downside excess tail in A period. Also, sediment was much weaker.

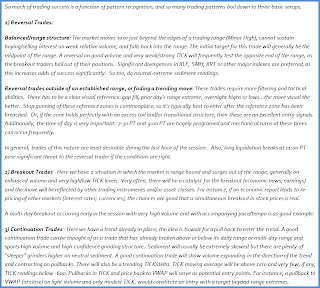

It also might be helpful to review the three core trade ideas.

Journal:

30 Minute Trade Exercise: Simulated Trade every 30 minutes if possible. New tactics, new ideas:

6:50: So far just a look below yesterday's range lows at 1392.25. We are long 1392.50, looking for a rotation to 1399.

7:05: New price lows down to 1391.25 without new lows in tick. Producing 1st significant bounce of the day. So far all that's occurred is stop gunning on waning momentum below yesterday's lows. Not looking good for sellers. Intermarket themes so far neutral, with the exception of Apple which is off 2%. Still looking for that rotation to A period highs. Value area high and POC rejecting upside price so far. Volume so far above that of last 4 days. Market should increase ATR today if that keeps up.

7:20: Initial balance coming to a close soon. VAH still rejecting upside price movement but at least a tick +600 was able to print.

7:30: Total failure of upside at VAH and new low in tick. Price still above range lows. Not sure what to make of this move. Value is still within yesterday's range. Looks like they're going to try for new lows here in C the period.

7:50: Still winding up for a downside range break. I am going to buy a failed breakdown. XLF already minor new low.

I liked your idea here. You tuned in quickly that the day was going nowhere really fast and that defined levels were holding. When you entered, the trade went positive. There was just no going over value area high today.

7:57: Trying a long here at 1391.75 with tight two point stop. This is a pure minor low trade with a tight target of VAH. Lower prices did not bring in volume and tick diverged.

8:30: Price is literally STUCK!!!!! at the POC and VWAP. The machines won't let it through. Going to up target to 1395.75 on this trade as if it does break, it should go beyond VAH.

8:37: Scratch the minor low trade. Another nasty rejection down and I'm going to let this thing do what it will and take a break. Looks like it wants to peak down lower.

9:17: We are long again here at 1392.50. Looking short in the hole here. All 5 points of it. LOL. Apple down farther to -2.8%, but Nasdaq not following. Interesting. Up, Up, and AWAY!!!!!! lol.

9:37: Well, a two hour range of 1.5 points. Somebody call a doctor!

10:55: Close of long trade for 1 point loss and will swing short here through overnight session.

11:30: So far it's looking like possible downside continuation. Here is the break. No volume coming in yet. It's going to take high volume to pull it away from value and I don't think there is enough volume. But the base was very tight so maybe that will help.

11:45: Classic example of a low volume look down below range extremes ( A #1 Reversal)l that didn't garner any increased participation and reversed. Look down and fail targets probably value area high.

I really should have entered a long here. But it's hard to fade yourself on a shorter time frame. Something that I'm not used to doing. But will try it next time! This gets trade of the day in my book.

12:05: Massive bonds spike lower. Unless something wired happens I think the close should occur around the POC/VWAP.

Friday, April 27, 2012

30 Minute Exercise

Below is a new exercise. Many of the trades are outside the realm of what I'd normally take. I want to engage the market more and experiment with more engagement. Grades are administered after the close. It turned out to be one of the most fascinating glimpses into the faulty thinking my mind engages in throughout the day. My frustration from closing my long mid-day grew into negative self-focus (instead of market focus) and revenge trading. It's painful to witness myself doing this stuff, but it's also a potentially powerful catalyst for change and improvement. As Brett says in the quote above, it's all about turning those mistakes and setbacks into goals and opportunities.

Next week I'll focus on:

1) Testing larger stops. Nothing under 5 points.

2) Diligent odds-based thinking at reference zones and before I enter or exit.

3) Trying harder to find trades every 30 minutes (when not in a trade).

4) Trying new tactics and ideas and discussing them.

Journal:

30 Minute Trade Exercise: Simulated Trade every 30 minutes if possible. New tactics, new ideas:

Morning Overview: Overnight sell-off got responsively bought back to over yesterday's highs. So far just a corrective pullback in A period. Value is higher again today. Inter-market themes very neutral. It's Friday, and I'll expect a balanced day most likely.

******************

Grade C -- You forgot to mention that the overnight printed a very strong follow through excess tail off of the lows. And at the very least, the structural cues you mentioned, should have garnered more of a positive bias. You forgot to remind yourself big picture: That the daily is in a high-confidence, multi-day move higher.

******************

6:50: Will be looking to get long at some point soon. Unless something really is obvious for entry, I'll be focused in on those key reversal times. End of A and B periods are high odds, if I've assessed this morning pullback correctly as just inventory re-balance. No unusual volume.

6:56: Bounce not waiting for 7:00 here and we will be looking to go long on the next tick pullback.

7:00: No tick/price pullback yet. Will go long here at the start of this period at 1397.25. Amazing how I watch for a pullback closely for 10 minutes, don't get it, and place an order long and it INSTANTLY -- AND I MEAN INSTANTLY -- takes massive heat and misses my 4 point stop by a tick.

7:07: They waited a few more minutes and there is the stop 1393.25. No increased volume and I'm not interested in reversing to the short side. Overnight poc possible target, but I'm still looking for a reversal soon as my stop out had no follow through and last bar was a doji.

7:08: Long again at 1394.75. My stop was taken out by a tick and LOD now 1393. Monday I'm making 5 points my default stop for this exercise. I want to experiment with stops until I find that zone of avoiding the stop guns and yet not taking a lot of big stops.

7:19: 1st solid bounce of day hits here. Would have liked higher than +550 tick reading, but it's Friday. Odds are, lows of the day are in and now the grind upwards will take hold.

7:32: Those friendly buy programs hit on time, just at the end of B period. IWM screaming higher.

7:40: I finally get to think in terms of targets now. I like overnight highs at 1403 for now. This is probably too aggressive of a target, without expecting a major wiggle. But the morning pullback was probably healthy and it turned perfectly at the end of initial balance. So it's a high-odds check-mark to balanced day. TICK has firmed well and is in a solid uptrend. All of the other indexes are above VWAP, except ES, so I expect ES to probably follow.

**************

Grade A -- You did a great job here framing this common, bull market type of structure. It's not rocket science. As it turned out, the stop was low tick, but we are working on that.

**************

8:00: 1st nifty reversal at VAH. But I think that the A period excess tail highs is the target. Tick is still strong and looking to be in a continuation formation with bodies and readings all above zero.

**************

Grade A -- How I could have out thought this analysis and closed my long before the A period highs were tested, is beyond me. The brain is a scary place to really look at.

**************

9:00: Price trying to grind higher, with nasdaq and small caps leading to the upside at day highs. But as per the rule these days, after 8:00 it is a two hour 1 point balance. Severe lag in energy and it's almost at range lows. XLF medium divergence. The vast majority of high relative volume stocks are very negative today. I think the upside is going to be much more difficult today. Especially with A period downside excess tail below the overnight lows. Yesterday, we had an upside excess tail in A period.

I'm going to take the trade off here for +2.75 here at 9:00 and re-evaluate through the non-movement doldrums.

*************

Grade "I'm not sure". You were correct here to see things that were unhealthy about today's market: That the market would probably have a rough time of pulling off a trender double distribution move like yesterday. But this information was not enough to discount a move to range highs, especially in light of a tight balance above VWAP with a tick moving average solidly above zero, IN A DAILY HIGH-CONFIDENCE, MULTI-DAY MOVE HIGHER!

Not to mention that at 8:00 you declared a move to range highs the target destination!!!!!!!!!!!!!

Then, to boot, you ditched this knowledge later in the day, and took a continuation long trade late session AFTER the market FAILED TO EVEN TAKE THE STOPS OUT ABOVE THE OVERNIGHT HIGHS. Also, the highs of the day were just a minor high above A period range highs. A very dicey proposition at best for a continuation trade to the upside. ESPECIALLY WHEN YOUR OWN ANALYSIS WAS QUESTIONING THE MARKET'S ABILITY TO EASILY MOVE HIGHER.

**************

10:26: Well, I'm astonished at myself. This entry here is essentially grading myself as a big fat D for the last analysis and exit of the trade. From the start of the day, you nailed the structure correctly. There was not a structural SNIFF of ANYTHING suggesting ANYTHING but a classic bull market check mark grinder in the context of a multi-day, high-confidence, bull-move higher. The same structural cues evident today as yesterday, especially the tick formation. There was NO OUT GUESSING THAT. All that's happened since my exit is a grind higher.

Sure there were a few divergences both up and down. That's the way it always is. Your exit was just due to boredom. And with structure like it was, there were going to be no generous pullbacks for re-entry. Too boot, YOUR WHOLE PURPOSE OF THIS EXERCISE WAS TO ENGAGE EVERY 30 MINUTES IF POSSIBLE. THERE WAS A CLEAN RE-ENTRY AT VWAP AN HOUR AFTER YOUR EXIT. YOU CAN'T EVEN FOLLOW YOUR OWN SIMPLE LITTLE EXERCISE PROTOCOLS WITH SIMULATED MONEY. I HONESTLY DON'T EVEN HAVE A FUCKING CLUE WHAT TO DO WITH YOU NOW.

You should have at least held the trade to the range highs. You'd have had some structural exit and you'd at least be green on the day. It will be something to work on next week. And I'm also going to start experimenting with big, structural stops.

10:45: Like yesterday, the double distribution breakout is in motion. We now monitor for continuation. XLF diverged, and that's never good. But in PURE momentum-driven multi-day, high confidence moves higher, these are times to not give a shit about every little divergence. Because momentum is driving the indexes proper!

10:53: I'm not interested long or short here. Double distribution looks to be possibly failing one tick shy of overnight highs.

But it's negative in my head and I need a half hour break to re-group from my stupid actions earlier in the day.

11:00: Will enter a trade at 11:00 long here. 1401.50. 4 point target, 3 point stop. If it fails below VWAP at 1399.50, I'm not interested. Going to walk away from the screen and let this trade play out.

************

Grade F: Ok, now you are really nuts. What happened to thinking in terms of odds? What happened to your break from the desk? When you acknowledged that you were not in a right place?

Here is how it should have gone.

1) Good that you honed in on monitoring for continuation or reversal at the range extreme of last night's overnight and the minor high above today's range highs. This is the reference zone and what you are supposed to do. Here is where you determine what the odds are for continuation or reversal.

2) "I'm not interested long or short here". This is not odds handicapping. It is stupidity and avoidance. Your next statement "Double distribution looks to be possibly failing one tick shy of overnight highs" was in fact a very relevant bit of information that increased the odds greatly for a reversal. So if you listened to your own analysis, you'd have put on a short trade for this exercise, instead of a long trade.

3) "Will enter a trade at 11:00 long here. 1401.50. 4 point target, 3 point stop". Brilliant work. You just handicapped price action to the downside and you go long. With a nonsensical 3 point stop to boot. Later you DOUBLED the position. Taking a break would have saved a big loss.

***************

11:30: So far one tick away from the stop. As I was taking a walk it was interesting to think about how I took that trade long -- for continuation -- when I had stated "It looks like the double distribution looks to be possibly failing one tick shy of overnight highs". All of the flags that I noted earlier, too, were high odds to rear their heads at range extremes -- not necessarily mid-range.

11:50: Adding another until here (5 contracts) long here at VWAP 1400.50. Same stop and target as first lot.

****************

Grade F: Oh my, now this is an example of a person who is more qualified to have a bed at the Alzheimer's home than trade futures. You just patted yourself on the back for seeing that this market had a key reversal at a key zone. And you made odds-based analysis discounting YOUR CURRENT LONG POSITION. YOU SAID NOTHING POSITIVE AT ALL TO SUPPORT YOUR IDEA ABOUT A CONTINUATION LONG BEING HIGH ODDS. YET YOU ADD ANOTHER UNIT TO THE TRADE?

****************

12:53: Stop out on both lots.

End of Day Totals: 1 win, 2 losses -$1600

Thursday, April 26, 2012

Wednesday, April 25, 2012

Tuesday, April 24, 2012

Monday, April 23, 2012

Thursday, April 19, 2012

After-Hours Report:

************

After Hours Report:

Today was a weird day and market structure was just odd. The afternoon break from the candidate balanced day morning distribution was drip-drip lower on very low volume. You just do not see very many breaks lower from the morning balance like this that just slowly grind. To boot, there were multiple negative tick 800 and negative tick 1000 readings: And with such strong program selling, and very little price movement, usually it's short-in-the-hole-time.

But today's reversal was to occur at the very visual point of control of three days ago. And then it BOUNCED!

I don't ever recall such an unusual double distribution session.

***********

After Hours Report:

Today was a weird day and market structure was just odd. The afternoon break from the candidate balanced day morning distribution was drip-drip lower on very low volume. You just do not see very many breaks lower from the morning balance like this that just slowly grind. To boot, there were multiple negative tick 800 and negative tick 1000 readings: And with such strong program selling, and very little price movement, usually it's short-in-the-hole-time.

But today's reversal was to occur at the very visual point of control of three days ago. And then it BOUNCED!

I don't ever recall such an unusual double distribution session.

***********

Wednesday, April 18, 2012

Daily Journal and After-Hours Report:

************

After Hours Report:

Today was probably the most picture-perfect balanced day session that I can remember. Inside range of both the overnight and prior day's session. Post-trend-day balance like this is very common.

I period minor look below range lows resulted a move to range highs. The L period minor look above range highs resulted a move to range lows.

Textbook in all respects.

NYSE Volume: 3,331

Globex Session Visualization Guess: Up

*************

Candidate balanced day

7:30--After yesterday's trend day we would expect a balanced day today. And that's what we have so far with an inside range initial balance of both the overnight session and the prior day's session.

The overnight session was flat to slightly up when about midway through the session it sold off and closed near range lows, which was also yesterday's value area low.

Small excess tail in A period. But all the initial balance highs could do is fill the gap down and reverse. Not even a probe above overnight highs or lows: All textbook balance day action.

Visualization & Odds: Obviously balance high odds. With a small a period excess tail in place odds are greater for a test of yesterday's range highs than they are for a test of yesterday's range lows.

For today to balance -- instead of selling off -- is a continuation pattern that will eventually lead to more upside the odds say. At least some sort of look higher.

Tactics: Unless something drastically changes we're going to be patient and play the range extremes. Watch for minor highs and minor lows as reversal zones. We will be playing for small targets, only at range extremes. Especially with only a 6 point range.

Range/ATR 5min:6 points / 1.5

NYSE Vol:743k

*************

Grade: A: I didn't feel the need to journal anymore today, as it there was not a sniff of anything but balance structure in place.

*************

After Hours Report:

Today was probably the most picture-perfect balanced day session that I can remember. Inside range of both the overnight and prior day's session. Post-trend-day balance like this is very common.

I period minor look below range lows resulted a move to range highs. The L period minor look above range highs resulted a move to range lows.

Textbook in all respects.

NYSE Volume: 3,331

Globex Session Visualization Guess: Up

*************

Candidate balanced day

7:30--After yesterday's trend day we would expect a balanced day today. And that's what we have so far with an inside range initial balance of both the overnight session and the prior day's session.

The overnight session was flat to slightly up when about midway through the session it sold off and closed near range lows, which was also yesterday's value area low.

Small excess tail in A period. But all the initial balance highs could do is fill the gap down and reverse. Not even a probe above overnight highs or lows: All textbook balance day action.

Visualization & Odds: Obviously balance high odds. With a small a period excess tail in place odds are greater for a test of yesterday's range highs than they are for a test of yesterday's range lows.

For today to balance -- instead of selling off -- is a continuation pattern that will eventually lead to more upside the odds say. At least some sort of look higher.

Tactics: Unless something drastically changes we're going to be patient and play the range extremes. Watch for minor highs and minor lows as reversal zones. We will be playing for small targets, only at range extremes. Especially with only a 6 point range.

Range/ATR 5min:6 points / 1.5

NYSE Vol:743k

*************

Grade: A: I didn't feel the need to journal anymore today, as it there was not a sniff of anything but balance structure in place.

*************

Tuesday, April 17, 2012

Monday, April 16, 2012

Daily Journal and After-Hours Report:

************

After Hours Report:

Pretty self explanatory notes in the journal. Today was one of those really neat days where you could really intuit why the market went to, and then reversed, at key areas. And it was all inventory re-balancing. Our Globex guess is up for tomorrow.

NYSE Volume: 3,311 Mil

Globex Session Visualization Guess: Up.

*************

7:05-- The open for today is at yesterday's value area high after the overnight session retraced Friday's late session spike down with a gap up. A period minor look above overnight highs and a straight shot open drive lower form there. Gap up just filled. The overnight lows are about five handles lower at 1360 and thus far visualizing that this is probably the destination.

Initial balance is so far just an inside range day, which by default, classifies this fast selling as inventory re-balancing. Overnight was long and now it's not!

Notable today is the aggressive selling in big cap momentum names and very aggressive intermarket themes. Bonds ripping higher Australian dollar ripping lower along with the Euro.

7:18 -- Overnight lows hit to the tick and small excess tail. A and B period are now very elongated, having printed a 15 point range. There is a gap fill below at 1375. Very good chance this is the next destination. But the selling is too liquidation-type of an event for me to expect a trend day down today. Probably a B formation type of day. Even after all of this vicious selling, the overnight lows have stopped to the tick, and we have nothing but a stop gun of Friday's lows on our hands.

7:40 -- IB closed with a to the tick test of the overnight lows and nice excess tail to boot. So now we monitor how/and if the B formation develops.

Candidate type of day: B formation

Visualization & Odds: With the elongated nature of the initial balance, an inside range of yesterday, combined with the perfect excess tail reversal at the overnight lows, odds are a great that today is a B formation. I will expect further tests of range lows, and only if the lows are broken with confidence will I shift the odds to a trending down type of day. If shorts are squeezed here, I expect a move up the half way back and the POC at 1368. Here, as i write this, tick is suggesting non-continuation to the downside at 7:43.

Tactics: For the rest of the day, I'll have to stay flexible.

Range/ATR 5min:15 / 3

NYSE Vol:

Sediment A/D&Up/Down Vol:-400 -200k

Sector Skew:72 up / 99 down

Most Up/Down Sectors: airlines +1.37%,

toys -4.40%, travel -3.36% leasure goods -3%, internet serv -2.89%

*************

Grade: B. Your structural assessment was spot on but your tactics were mushy. Would have liked more if/than scenarios. You had your B formation day in mind, so be more specific.

*************

9:00--

Structure: So far our structural analysis was spot on. The elongated initial balance stopping and forming an excess tail at the overnight lows produced a buy response back to the point of control and just shy of halfway back. Price is now lurking just above that range lows.

I'm expecting a test of the range lows and probably a look down attempt. And I expect the lookout attempt to fail as two day has all the hallmarks of a B formation. One strong factor that I'm noticing is the extremely divergent small cap indexs. I think this bodes well for the long side, and the tick is also very strong too. Price may not make it to lows before a reversal hits.

*************

Grade: B -- I liked how you were prepared to buy a false look down of the lows. I got to busy actually trading to journal that I entered a trade near this time. And ended up long near the transitional lows about 9:30.

*************

11:00--

The VWAP and halfway back finally gave away and a strong push now to near yesterday's point of control. On reversal watch here. Have to leave office.

After Hours Report:

Pretty self explanatory notes in the journal. Today was one of those really neat days where you could really intuit why the market went to, and then reversed, at key areas. And it was all inventory re-balancing. Our Globex guess is up for tomorrow.

NYSE Volume: 3,311 Mil

Globex Session Visualization Guess: Up.

*************

7:05-- The open for today is at yesterday's value area high after the overnight session retraced Friday's late session spike down with a gap up. A period minor look above overnight highs and a straight shot open drive lower form there. Gap up just filled. The overnight lows are about five handles lower at 1360 and thus far visualizing that this is probably the destination.

Initial balance is so far just an inside range day, which by default, classifies this fast selling as inventory re-balancing. Overnight was long and now it's not!

Notable today is the aggressive selling in big cap momentum names and very aggressive intermarket themes. Bonds ripping higher Australian dollar ripping lower along with the Euro.

7:18 -- Overnight lows hit to the tick and small excess tail. A and B period are now very elongated, having printed a 15 point range. There is a gap fill below at 1375. Very good chance this is the next destination. But the selling is too liquidation-type of an event for me to expect a trend day down today. Probably a B formation type of day. Even after all of this vicious selling, the overnight lows have stopped to the tick, and we have nothing but a stop gun of Friday's lows on our hands.

7:40 -- IB closed with a to the tick test of the overnight lows and nice excess tail to boot. So now we monitor how/and if the B formation develops.

Candidate type of day: B formation

Visualization & Odds: With the elongated nature of the initial balance, an inside range of yesterday, combined with the perfect excess tail reversal at the overnight lows, odds are a great that today is a B formation. I will expect further tests of range lows, and only if the lows are broken with confidence will I shift the odds to a trending down type of day. If shorts are squeezed here, I expect a move up the half way back and the POC at 1368. Here, as i write this, tick is suggesting non-continuation to the downside at 7:43.

Tactics: For the rest of the day, I'll have to stay flexible.

Range/ATR 5min:15 / 3

NYSE Vol:

Sediment A/D&Up/Down Vol:-400 -200k

Sector Skew:72 up / 99 down

Most Up/Down Sectors: airlines +1.37%,

toys -4.40%, travel -3.36% leasure goods -3%, internet serv -2.89%

*************

Grade: B. Your structural assessment was spot on but your tactics were mushy. Would have liked more if/than scenarios. You had your B formation day in mind, so be more specific.

*************

9:00--

Structure: So far our structural analysis was spot on. The elongated initial balance stopping and forming an excess tail at the overnight lows produced a buy response back to the point of control and just shy of halfway back. Price is now lurking just above that range lows.

I'm expecting a test of the range lows and probably a look down attempt. And I expect the lookout attempt to fail as two day has all the hallmarks of a B formation. One strong factor that I'm noticing is the extremely divergent small cap indexs. I think this bodes well for the long side, and the tick is also very strong too. Price may not make it to lows before a reversal hits.

*************

Grade: B -- I liked how you were prepared to buy a false look down of the lows. I got to busy actually trading to journal that I entered a trade near this time. And ended up long near the transitional lows about 9:30.

*************

11:00--

The VWAP and halfway back finally gave away and a strong push now to near yesterday's point of control. On reversal watch here. Have to leave office.

Friday, April 13, 2012

Narrative, Visualization Exercise and After-Hours Report:

************

After Hours Report:

An interesting day today as yesterday's entire rally got re-balanced. An elongated trend day has not been taken back in one fell-swoop since last December. This probably portends more downside and, at the very least, puts us out of the grinder up mindset.

I will note in the annotated charts that today was also a day where fades of tick extremes were profitable -- and clearly indicated that strong responsive sellers were in control.

Late Friday M period declines are nearly impossible to get, simply because the lead in gets you away from the desk and doing other things -- just because it's so dang slow. But the A period excess, extreme money flow readings, perfect price rejects on tick extremes, and the inability to penetrate value area high, were all clues to what transpired. That juicy visual destination is just too tasty to resist.

NYSE Volume: 3,308 Million

Globex Session Visualization Guess: Down

*************

7:30--

Structure: Inside range value area. Initial balance closes on it's lows and is still cratering. TICK structure, right from the get go, was signaling impending doom with a firm base below zero. So far not even a reading close to +500. C period lows now well into yesterday's A period excess tail and bouncing at S1. Is that it? We will need to see a tick reading +600/800 if we are even to think of a reversal here. Inter-market themes are aggressively negative with strong trends.

Visualization & Odds: The character of the market has definitively changed now. Today should have been a benign balanced type of day after yesterday's ramp higher.

Anything can happen now that yesterday's rally has been given back with confidence.

Hard to know for sure, but so far I'm leaning towards the fact that things could get really ugly today. A trend day down is not out of the question at all, but 8:00 and 9:00 reversal zones are coming up. 7:48 -- tick is starting to diverge here on a re-test of the lows but with the TICK MA so weak at -500, it might not matter. New lows here with fresh tick lows too. The obvious destination is at least yesterday's A period lows at 1364. For it to come this far and not test yesterday's range lows would be surprising to me.

8:07 -- Well, mercy me, 1368.25 appears to be it as tick has finally printed a +600. A failure to quickly push lower, and test yesterday's range lows, will have me thinking that this market will re-trace to halfway back. But it's going to be another 45 minutes before we can make our call.

Tactics -- Don't rush in. Let this play out.

Range/ATR 5min:

NYSE Vol:960,906k @ 7:45

Sediment A/D&Up/Down Vol:-1722 / -478k

Sector Skew:14 up / 158 down

Most Up/Down Sectors:

Tobacco +.46%, Utilities many variants +.36%

Coal +3% (total u turn here), Banks, oil equipment -2.5%

*************

Grade: A -- That's exactly what happened -- it retraced to halfway back. And even though it made you wait, yesterday's range lows was the final destination.

Even though I noted the tick divergence at the 8:00 morning lows, I hated to take a long trade there with yesterday's range lows so close. So, even though I missed the reversal, I'm ok with it as 8 out of 10 times, I'll get stopped out buying just above a visual reference.

*************

9:00--

Structure: 8:00 reversal did take price back to halfway back and vwap before a clean reversal. With the A period excess tail above, there is a chance that the lows are not in yet, however, I think it's high odds that they are. Especially because yesterday's lows were not able to be tested.

Visualization & Odds: High odds that lows of the day are in. And that it's balanced chop in the lower part of the profile from here on out. I don't think that the highs will be tested.

Tactics: With Friday volume tapering off quick, I'll consider buying range lows. But other than that, buying in the middle of this B formation is not enticing at all.

Range/ATR 5min:12 points

NYSE Vol:1, 694 9:30

Sediment A/D&Up/Down Vol: -1448/ -729

Sector Skew:35 up / 137 down

*************

Grade: A. You get an A even though the lows were taken out end of day. It would have been nice to have noted the negative cumulative delta build. And the tick reversals from the extreme readings.

And had divined a late session breakout to the destination.

But at least you realized to just stand aside and not get chopped up. And you correctly saw the upside as futile. And this shows how well you are intuiting structure, even before it unfolds.

*************

10:15 --

Structure: Interesting juncture here at vwap base. This is a potentially bullish pattern and we might get a push higher -- although probably not much. Tick moving average now above zero and tick is in solid uptrend. Any up move is going to have a hard time with value area high.

Still mostly think that this is a solid B formation type of day.

Visualization & Odds: Ultra-high odds I think of a B formation day. If there is to be any possible range extension, it will be lower probably.

Tactics: Nothing to do at mid-range here.

11:00 -- Sure enough, a cute look above vwap to value area high and reversal right at the programmed 11:00.

*************

Grade: A. A look above vwap to value area high and reversal. You called it exactly right, and I wish that I'd have taken that short in hindsight, given the tick structure. I was very outspoken about lower -- not higher. You were certain that if any range extension, it would be lower. Lots of downside odds. Remember the A period excess? The inability to get above VAH?

*************

After Hours Report:

An interesting day today as yesterday's entire rally got re-balanced. An elongated trend day has not been taken back in one fell-swoop since last December. This probably portends more downside and, at the very least, puts us out of the grinder up mindset.

I will note in the annotated charts that today was also a day where fades of tick extremes were profitable -- and clearly indicated that strong responsive sellers were in control.

Late Friday M period declines are nearly impossible to get, simply because the lead in gets you away from the desk and doing other things -- just because it's so dang slow. But the A period excess, extreme money flow readings, perfect price rejects on tick extremes, and the inability to penetrate value area high, were all clues to what transpired. That juicy visual destination is just too tasty to resist.

NYSE Volume: 3,308 Million

Globex Session Visualization Guess: Down

*************

7:30--

Structure: Inside range value area. Initial balance closes on it's lows and is still cratering. TICK structure, right from the get go, was signaling impending doom with a firm base below zero. So far not even a reading close to +500. C period lows now well into yesterday's A period excess tail and bouncing at S1. Is that it? We will need to see a tick reading +600/800 if we are even to think of a reversal here. Inter-market themes are aggressively negative with strong trends.

Visualization & Odds: The character of the market has definitively changed now. Today should have been a benign balanced type of day after yesterday's ramp higher.

Anything can happen now that yesterday's rally has been given back with confidence.

Hard to know for sure, but so far I'm leaning towards the fact that things could get really ugly today. A trend day down is not out of the question at all, but 8:00 and 9:00 reversal zones are coming up. 7:48 -- tick is starting to diverge here on a re-test of the lows but with the TICK MA so weak at -500, it might not matter. New lows here with fresh tick lows too. The obvious destination is at least yesterday's A period lows at 1364. For it to come this far and not test yesterday's range lows would be surprising to me.

8:07 -- Well, mercy me, 1368.25 appears to be it as tick has finally printed a +600. A failure to quickly push lower, and test yesterday's range lows, will have me thinking that this market will re-trace to halfway back. But it's going to be another 45 minutes before we can make our call.

Tactics -- Don't rush in. Let this play out.

Range/ATR 5min:

NYSE Vol:960,906k @ 7:45

Sediment A/D&Up/Down Vol:-1722 / -478k

Sector Skew:14 up / 158 down

Most Up/Down Sectors:

Tobacco +.46%, Utilities many variants +.36%

Coal +3% (total u turn here), Banks, oil equipment -2.5%

*************

Grade: A -- That's exactly what happened -- it retraced to halfway back. And even though it made you wait, yesterday's range lows was the final destination.

Even though I noted the tick divergence at the 8:00 morning lows, I hated to take a long trade there with yesterday's range lows so close. So, even though I missed the reversal, I'm ok with it as 8 out of 10 times, I'll get stopped out buying just above a visual reference.

*************

9:00--

Structure: 8:00 reversal did take price back to halfway back and vwap before a clean reversal. With the A period excess tail above, there is a chance that the lows are not in yet, however, I think it's high odds that they are. Especially because yesterday's lows were not able to be tested.

Visualization & Odds: High odds that lows of the day are in. And that it's balanced chop in the lower part of the profile from here on out. I don't think that the highs will be tested.

Tactics: With Friday volume tapering off quick, I'll consider buying range lows. But other than that, buying in the middle of this B formation is not enticing at all.

Range/ATR 5min:12 points

NYSE Vol:1, 694 9:30

Sediment A/D&Up/Down Vol: -1448/ -729

Sector Skew:35 up / 137 down

*************

Grade: A. You get an A even though the lows were taken out end of day. It would have been nice to have noted the negative cumulative delta build. And the tick reversals from the extreme readings.

And had divined a late session breakout to the destination.

But at least you realized to just stand aside and not get chopped up. And you correctly saw the upside as futile. And this shows how well you are intuiting structure, even before it unfolds.

*************

10:15 --

Structure: Interesting juncture here at vwap base. This is a potentially bullish pattern and we might get a push higher -- although probably not much. Tick moving average now above zero and tick is in solid uptrend. Any up move is going to have a hard time with value area high.

Still mostly think that this is a solid B formation type of day.

Visualization & Odds: Ultra-high odds I think of a B formation day. If there is to be any possible range extension, it will be lower probably.

Tactics: Nothing to do at mid-range here.

11:00 -- Sure enough, a cute look above vwap to value area high and reversal right at the programmed 11:00.

*************

Grade: A. A look above vwap to value area high and reversal. You called it exactly right, and I wish that I'd have taken that short in hindsight, given the tick structure. I was very outspoken about lower -- not higher. You were certain that if any range extension, it would be lower. Lots of downside odds. Remember the A period excess? The inability to get above VAH?

*************

Subscribe to:

Comments (Atom)