NYSE Volume: 3,264,556,000

Globex Session Visualization Guess: 1st of the month come Monday. With the market in balance, I think that a gap up is the high odds bet come Monday.

*************

7:30-- Welcome to Friday! Moderate gap up of about six points and an open drive, choppy drive lower. Today's value is slightly above the midpoint of the last 10 days range. The initial balance low is 1 tick shy of filling the opening gap. The NASDAQ and the Russell are both to diverged lower, having fill their gaps and then some.

Probably what is paramount to understand now that the market is in a 10 day range. Looking at the the daily chart of the candlesticks really doesn't help the eye catch that the market is now firmly in a range.

The obvious trade idea right now is to buy the gap fill at 1398. But as I type this report just after the initial balance, a flurry of sell orders are breaching the gap level. The weakness of the other indexes, and the A period downward excess was a tell that this might occur.

If price continues to explore downward, the obvious reference would be yesterday's value area high at 1393, and halfway back zone. Then the prior day POC at 1389 and then the prior day range lows at 1386.

Intermarket teams are rather neutral with no significant trends or spikes.

*********

Grade C: I wish that you had framed your analysis in terms of SOME tactical strategies. When you were writing about the gap being filled, and then the stops run, it would have been nice for you to acknowledge this as a significant reference area and evaluate if it would be a high odds long trade or not.

**********

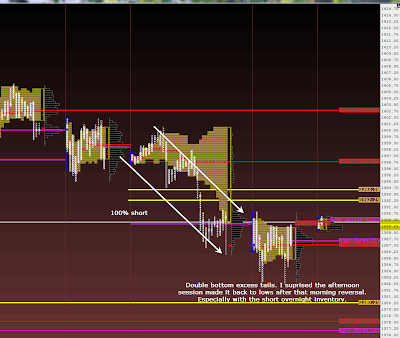

7:44 -- Small buy response at ES daily pivot/and peak below overnight lows. This could be the destination. Low of day so far is 1395.75. 2 points below gap fill reference and just a peak below overnight session lows. This has "stop gun" written all over it. So we monitor this reversal as a potential low of the day move. This is a "no change" zone, meaning that a move to this area is high odds to be just an inventory re-balance. All of the other indexes are above the prior day lows as well.

If the excess lows of the day here hold, I visualize a balance day and a possible upside trend. Lows of the day, this time of day in a no change zone, can be very positive for upside movement. If the current lows don't hold, and a significant additional move down occurs, then we re-evaluate. But thus far I'm not seeing any indication, other than the significantly negative money flows, that this morning move down was anything other than a rebalancing of the long overnight inventory.

Range/ATR 5min:7 points / 2.14

NYSE Vol:708k

Sediment A/D&Up/Down Vol:+280 / +7k -- Neutral extreme

Sector Skew:98up / 74 down

Most Up/Down Sectors: tobbaco +1.5%, Healthcare Providers +1.18%, Reits +1.06%

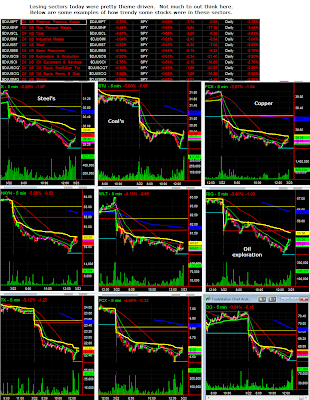

tires -2.46%, Coal +2.41%, Airlines -2.33%

*************

Grade:B -- One of the downsides of spending so much cognitive effort putting together a journal is that you can miss trades as a result. Today, I missed pulling the trigger at the overnight lows. Just too caught up in my analysis. And not BELIEVING my analysis, and REALIZING that the lows were a great, low odds long side trade, with 3 different references to support it in a "no change zone". Analysis paralysis as they say. But still I was able to internalize movement and structure as the lows of the day were put in. When multiple reference points lineup together reversals can be powerful. I was a great experience to be fully focused and engaged as the reversal hit.

Weird how the mind is so blinded by confirmation bias. Being the innovator at a excess low is not easy! Even in a trend up daily.

*************

9:00-- From the lows it was a straight shot bounce up to value area high. Approximately a 1/2 hour long base here at the value area highs. NASDAQ and Russell still diverged to the downside. Intermarket market teams still extremely neutral. It is Friday. I visualize two high odds scenarios. Either this market prints a low volatility check mark grinder higher, with limited upside. Or its chips chops around lower within the value area for the rest of the day as volume tapers off.

Tactical: Straight shot move from the lows and there are two options from here on out. Having missed buying the C period lows, I can buy the consolidation here at value area high in anticipation of continued range extension above range highs and a check mark grinder higher. The upside to this trade is that there are pretty good odds that at least a look above the initial balance highs will occur. The downside is that it is a Friday and volume will continue to decrease along with volatility. Further negatives are that the NASDAQ and Russell are still diverged and far from their highs. Other negatives are that sentiment is neutral extreme and money flows are negative. So although it may continue to go up, I'd say that the upside is probably very limited. And this market could easily probe down to the lows of the value area. I think that the risk to reward sucks.

Alternatively, I could sell this consolidation area at value area high but at the very most I see the risk to reward at 1:1. The upside of selling here is that the tick moving average is moving down dramatically. But I'm just not excited about a counter trend short after such a strong move off the C period lows with excess. I think that any move down from highs here will quickly run into the point of control, halfway back, or value area low, and bounce. Excess longs have already been re-balanced.

My strategy will be to wait and see if there is a probe of the value area low or range lows, and at that time consider a long trade. I'd do not wish to take any continuation trades today. Just a reversal at or near range lows.

The bottom line is that I see little risk to reward for any trades from here on out. If for some reason volume and does not continue to decline and or a significant pullback to value area low or even range lows or occur, then maybe a trade will present itself.

Range/ATR 5min:10 points / 1.23

NYSE Vol:1,435,000

Sediment A/D&Up/Down Vol: +942 / +340k

Sector Skew:135 up / 39 down

Most Up/Down Sectors:

*************

Grade:A I liked your analysis. You thought through the scenarios, and you visualized the rest of the day well.

*************

10:00 -- BIG spike down in bonds. BIG spike up in AUD. Indexes pushing higher but not yet above range. I'm surprised at this as would normally be considering a long trade here. Well, it's Friday, a great day for dislocations to flourish and for a market to stay dead.

10:20 -- Fresh spikes in bonds and AUD. Indexes finally starting to respond a little. USD not moving.

10:30-- Have to leave office for today. Looks like the checkmark is in control unless one of these wacky inter-market theme spikes throws a big hairball into the scenario.

Range/ATR 5min:

NYSE Vol:1,890,000

Sediment A/D&Up/Down Vol: +890 / +427

Sector Skew:

Most Up/Down Sectors:

*************

Grade:A There really was not much movement. Glad that I left the desk.