**************

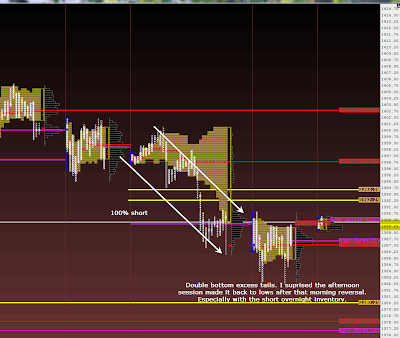

After hours report: It is pretty funny to note my cognitive dissidence this morning while doing my post market grading. It was a tricky market today with a lot of cross currents. I'm still surprised that they were able to push it down to do a retest of the range lows. Although there are two excess tails at the lows now, I'm wondering if this is a change of character for the market and that there might be more downside ahead.

**************

7:30 -- It's been a long while since we've had an opening "with change". A true gap down of about 10 points and a tight range initial balance.(So, the rally in bonds all day yesterday was saying something it appears?) Some news hit the market last night and about midway through the overnight session, value started to move lower and the session closed on its lows. With shorts 100% short, and a tight initial balance that is not continuing to go down, I am on short in the hole watch. Additionally, there are significant upside index divergences with technology and the NASDAQ. It is hard for me to visualize structure right now as I need more time for things to unfold. I have a downside bias but so far it is not being confirmed. And responsive buyers have been viciously effective for eternity now. But one of these days the responsive buyers are going to fail and multiple time frames are going to liquidate. Will it be today?

Range/ATR 5min: 4 points / 2.48

NYSE Vol:777,991,000

Sediment A/D&Up/Down Vol:-1472/-289k

Sector Skew:12 up / 156 down

Most Up/Down Sectors:

internet serv +.44

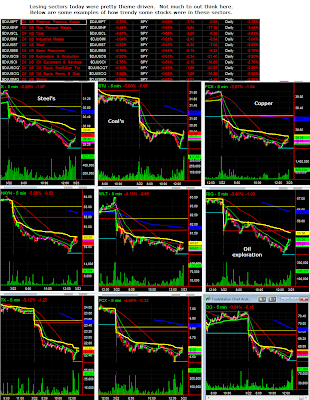

platinum , coal, non-ferrous metal, steel, resources -3% -- top 10 losers all metals, oil, resources. The theme is clear.

*************

Grade D: Cognitive dissonance is such a wonderful thing. I go from being on short in the hole watch (an upside stance due to multiple reasons) to saying that I cannot formulate a visualization now (which I had just done), to stating that I have a downside bias. Then I even point out a couple more points against the downside bias. Geez, what a joke.

I cannot even believe that was me writing that.

*************

9:00-- The push down out of the initial balance was not confirmed by a few key sectors such as technology. Pace and tempo of the break down were suspect as well. And the market quickly got short in the hole right at 8:00. The reversal off lows so far is back to the point of control and halfway back. It looks like the downside is done. There is no downside continuation pattern to be had with such a strong reversal and an excess tail at lows. I need more information before I can visualize with any real bias. But I'll go ahead and make a guess that this market closes on its highs. The gap above is just a huge magnet and lack of follow-through to the downside, by default, has to have me thinking up.

Range/ATR 5min: 11 points / 3.29

NYSE Vol:1,598,000

Sediment A/D&Up/Down Vol:-1472/-289k

Sector Skew:16 up / 160 down

Most Up/Down Sectors:

internet serv +.44

platinum , coal, non-ferrous metal, steel, resources -3.78% -- top 10 losers all metals, oil, resources. The theme is clear.

**************

Grade B minus: once again here I am making lots of decent points about structure, and then writing that I don't have enough information to formulate a bias.

I'm pretty sure that today I was just afraid of being wrong. It was our first day of increased volatility and it probably just spooked me a little bit.

You did good to visualize a close at highs. Today's close was close to highs. Isn't it strange that two words spelled the same way can mean different things? No wonder it's hard to learn English : )

**************

10:30-- No new big developments since the last update. It has been basing at the upper end of the value area. And the case is growing even stronger for an upside attempt into the gap. Minus energy and material related sectors, there are just a lot of green sectors today, and up stocks. At this point I will be very surprised if there is not an upside push. Although sediment is still neutral and not able to spike higher. I visualize a 75% chance for a move up into the gap. If we do move up within the gap, the chances of actually filling the gap are 50%. If this market wants to base for the rest of the day then it can. There's a 35% chance that it can.

Range/ATR 5min: No change

NYSE Vol:2,300,000

Sediment A/D&Up/Down Vol:-1489/-590k

Sector Skew:19up/154 down -- ever so slight improvement

Most Up/Down Sectors:

*************

Grade B: The fact was that sentiment was stubbornly negative as I noted. And I also noted extreme weakness in the energy and material sectors. The market had a retest of the lows in mind and I'm still a little surprised that they were able to pull it off but there were a few clues ahead of time.

*************

No comments:

Post a Comment